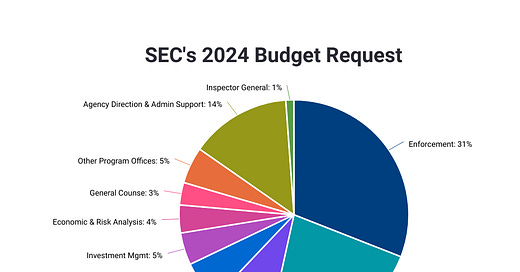

Congress recently passed a $1.2 trillion budget, appropriating $2.15 billion to its Securities and Exchange Commission (SEC). With the vast majority of the funds budgeted for enforcement, the regulator can rest easy knowing that its coffers are filled with the resources needed to prolong its taxpayer-funded lawfare campaign against fintech innovators and their investors.

Indeed, hundreds of millions of dollars is quite a generous reward for the division of the SEC that was just caught, red-handed, “abusing the judicial process” and “deliberately perpetuating falsehoods.”

I am referring specifically to the SEC’s lawsuit against DEBT Box, a little-known cryptocurrency firm that had its assets unilaterally frozen by Biden’s securities directorate last July.

For those who haven’t been following the DEBT Box saga, let me fill you in, because this one is truly a stunner.

Accusing DEBT Box and various related individuals of securities fraud, the securities arm of the administration that preaches about democracy, obtain a sealed, ex parte temporary restraining order (TRO) to freeze not only the company’s assets, but also those of individuals who allegedly received assets from the company.

This TRO - which was obtained without any prior notice and without the accused being present in court to defend themselves - also included a court appointed out-of-state Receiver. I’m not talking about a piece of stereo equipment or the kind of receiver who catches a ball made of pigskin. This is the kind of Receiver who has the power to take control of and liquidate one’s business.

But that’s not even the worst part.

It turns out that the SEC obtained its asset-freezing, business-grabbing TRO by brazenly lying to court.

Fortunately, the SEC’s deception resulted in a blistering judicial ruling where the agency was not only ordered to pay the legal fees of DEBT Box, but also had its motion to dismiss DENIED without prejudice - meaning that the SEC will not be able to refile the same charges at a later date.

If you thought that sanctions as well as a scathing rebuke of the SEC’s conduct would restrain the disgraced regulator from further egregious overreach, you would be dead wrong.

In fact, it appears that its DEBT Box debacle has only empowered the commission to double-down on tyranny.

Within just days of the DEBT Box ruling, the SEC was back to castigating its favorite cryptocurrency target, Ripple Labs. In a new filing, also shrouded in secrecy, the SEC demanded nearly $2 billion dollars from Ripple Labs as well as its founder and CEO.

According to the now unsealed motion, the regulator is seeking a staggering $1.95 billion in “penalty fees” - of which more than half is for disgorgement and interest.

The problem with this extortionate demand is that in order to collect disgorgement penalties, the regulator would need to demonstrate that individuals suffered financial losses. However, the SEC has failed to identify even one victim.

Not one.

Couching the ludicrous sums of disgorgement money that a government collects from its citizens, in the absence of any victims, as “fines” is in and of itself a grave injustice.

The time has come to label these draconian fines and penalty fees for what they truly are: wealth confiscation.

Chillingly, this blatant wealth confiscation is not limited to merely one rogue three-letter federal agency.

Look around.

It is becoming glaringly obvious that wealth confiscation has become the core mission of nearly every federal department that exists today.

The federal printing press has confiscated over 20% of our purchasing power in just the last few years alone, in the form of inflation.

At the same time, the Department of Labor is being weaponized to ban retirement accounts from actually accessing the very assets that would protect savers from government-manufactured inflation.

And don’t get me started on the IRS. Even children are are sobbing about wealth confiscation via taxation. Just look at this video circulating around social media!

While the IRS develops its plans to hire - and arm - nearly 87,000 new agents, it has made repeated attempts, in recent years, to mandate cryptocurrency disclosures - regardless of whether or not a taxable event has even been triggered.

I hate to break it to you but these locked and loaded IRS agents are being employed to seize your wealth - not to make sure that you receive your tax refund on time!

Some politicians, including Joe Biden and Elizabeth Warren, have even introduced proposals to confiscate wealth by taxing unrealized capital gains. Such initiatives could progress into the greatest wealth grab in American history as citizens would be forced to liquidate even unrelated assets, at fire sale prices, just to muster up enough cash to afford the tax liability on investments that have grown in value.

Imagine being forced to sell your home simply because you hold appreciated Apple stock in a brokerage account. And to avoid being indicted in certain states like NY, you better make sure that your house is sold below market rates. Heaven forbid you sell at a premium, you could risk being “fined” 2,400% more than the value of what a court dictates your property is worth!

Fortunately, decentralized innovation has emerged to safeguard we-the-people from these tyrannical wealth seizures - because the only thing worse than giving government agencies the power to take away your money, is paying them to do it.

PREVIOUS DECENT MILLIONAIRE ARTICLES REFERENCED IN THIS POST:

Why Does Biden Oppose Investing Freedoms for Everyday Americans?

Anyone, who has been reading my articles and research papers over the years, knows how passionate I am about amending, if not abolishing, the accredited investor rule so that all Americans are given the freedom to invest their own money where and how they choose.

Some Brassy, Perhaps Offbeat, Financial Forecasts for a Wildly Unpredictable 2024

Tis the season to be prognostic. That time of year when I get to evaluate my previous predictions as well as channel my inner prescient powers to see what lies ahead. Last year’s article, which envisioned how decentralized innovation will shape humanity, was probably one of the most prophetic articles I had ever written. Everything foretold has either co…

Blockchain and Fintech Innovation will Save America from Purchasing Power Erosion

Those who have read my 2024 predictions post know that I’m on the Paul Krugman exercise regimen where I do 100 sit-ups, 50 jumping jacks and 5 minutes of planking every time Paul Krugman publishes an article lauding the U.S. economy. Thanks to Mr. Krugman, I expect to have washboard abs by the time the summer arrives.

Biden’s War on Digital Assets: Part One – The Battle for Your Retirement Savings

In case you haven’t noticed, there is a war going on. However, this war is not in the Ukraine. Nor is it against Russians. Rather, these battles are being fought right here on US soil, with regulatory bullets, against decentralized finance and digital assets.

Recap of Last Week's Battles in the War Between the Centralists and Decentralists

This past September, I channeled my inner Ayn Rand to publish a piece which depicted how the Decentralists overcame significant obstacles to win the most pivotal war in the history of mankind. You can read it here. Because the article takes place in the year 2055, people assume it is a work of fiction. Truth be told, it is more of a futuristic biopic of …