Some Brassy, Perhaps Offbeat, Financial Forecasts for a Wildly Unpredictable 2024

BTC to Reach $120K in 2024, Tokenized RWAs to Create Unprecedented Crypto Market Growth, SEC & Keynesian Economics to be Obsoleted, Fintech IPO to Ignite Economic Boom, Creative Media M&A

Tis the season to be prognostic. That time of year when I get to evaluate my previous predictions as well as channel my inner prescient powers to see what lies ahead.

Last year’s article, which envisioned how decentralized innovation will shape humanity, was probably one of the most prophetic articles I had ever written. Everything foretold has either come to fruition or is in the process of unfolding.

I accurately predicted that the SEC’s overreaching enforcement action against Ripple would backfire, be appealed, and cease to result in any legislative action clarifying the definition of cryptocurrencies.

I was also correct in forecasting that HODLers would be rewarded. And boy were they ever in 2023! The cryptocurrency market capitalization this past year has more than doubled with Bitcoin up over 150%, Ethereum up over 90%, Chainlink up 175% and the latest blockchain darling, Solana, up over 900%.

I was also on target in projecting that decentralized innovation would be seeping into most industry sectors. I am witnessing this firsthand, on triweekly CryptoOracle Collective zoom calls, where many of the most promising web3 ventures and some of the industry’s smartest investors showcase decentralized projects on the cusp of disrupting healthcare, retail, entertainment, media, education, business services and even energy. I view this proliferation of quality web3 ventures - particularly during one of the driest periods for startup funding - as a clear indication that web3’s mark on society stands to be both inevitable as well as indelible.

Other than decentralization will continue to advance humanity and that cryptocurrency prices will keep soaring, I can confidently predict that 2024 is going to be anything but predictable. But I won’t let that stop me from making some really brassy, perhaps offbeat, forecasts.

Fasten your seatbelt, below are my top ten predictions for a wildly unpredictable 2024.

PREDICTION #1 - THE CRYPTOCURRENCY MARKET HASN'T EVEN REACHED 1% OF ITS POTENTIAL

While I’d love to double, triple or even quadruple down on last year’s prediction that HODLers will be rewarded, not even 4X the conviction comes close to my certitude that the market cap for cryptocurrencies has only begun to mushroom. In fact, I believe that the cryptocurrency market has yet to reach even 1% of its potential - particularly when accounting for the tokenization of Real-World Assets (RWAs).

Tokenization, a process that uses blockchain technology to create digital representations of physical assets, constitutes the greatest wealth creation opportunity in the history of mankind. And it will transform the cryptocurrency industry from a tiny, fringe marketplace into the nucleus of global finance.

Bain Capital estimates that the value of private assets existing outside of financial services (RWAs) to be $540 trillion. That is more than 300 times the size of the current cryptocurrency market cap! Tokenizing even a shred of RWAs would produce unparalleled market growth never before experienced on earth - perhaps not on any other inter or extra galactic planet either.

PREDICTION #2 - KEYNESIAN ECONOMICS IS ON THE BRINK OF EXTINCTION

Particularly with blockchains like Ethereum and Solana accelerating the growth of DeFi apps, I remain more convinced than ever that decentralized finance will ultimately dethrone legacy finance.

But, it isn’t just the centralized financial system that is on the precipice of displacement. Today's economic foundation is also buckling under a centrally controlled framework. I wasn’t being hyperbolic in forecasting that Keynesian economics would eventually be obsoleted by decentralized innovation. Anyone who still believes that Keynesian economics will underpin future economies is simply not paying attention.

Record homelessness, uncontrollable inflation, dwindling demand for government securities, consumer debt at all-time highs and one individual taking on multiple jobs just to afford basic necessities are not characteristics of a healthy economy. They are manifestations that the Keynesian “cure” is, in fact, the disease.

Although it won’t happen in 2024, Keynesian economics is on its way to becoming an endangered macroeconomic system. Fortunately, decentralized innovation has begun paving the way for superior solutions like Participate2Earn Economics and Blockonomics to emerge and replace it.

PREDICTION #3 - THE 2024 U.S. ECONOMY IS GOING TO LOOK VERY ATTRACTIVE - ON PAPER

During this high-stakes election year, and with centralists growing increasingly more desperate to cling to power, at least one engineered black swan event sprinkled with a few October-like “surprises” would not shock me in the slightest.

But don’t conflate shock with doom. There are good reasons to expect to be pleasantly surprised in 2024, for the uglier the polls look for incumbent, the prettier the economic headlines and the more miraculous America’s economic recovery will be.

In fact, I am so convinced that the New York Times will be teeming with feel-good economic articles from Paul Krugman that I have decided to base my 2024 exercise regimen on it. My New Year’s Resolution is to do 100 sit-ups, 50 jumping jacks and 5 minutes of planking every time Paul Krugman publishes an article lauding the U.S. economy. Thanks to Mr. Krugman, I expect to have washboard abs by the time the summer arrives.

Although the government is likely to release favorable economic numbers in 2024, don’t expect those figures to be based on factual data. I mean, why have an actual functioning economy when it is much simpler to have an economy that merely identifies as a functioning economy?

Although it is not sustainable in the long run, markets can indeed expand quite nicely in a fairy tale economy. With nearly everyone using the same flawed government metrics for their algorithms and allocation models, the markets can be temporarily propped up by technicals as opposed to fundamentals. Thanks to herd mentality, it is safe to assume that the self-serving optimistic government economic data, whether sound or not, can herald a stampede of bulls in 2024.

But don’t be fooled. Unless pragmatic economic solutions are implemented, the bull parade will only last for so long as the truth can no longer be masked with rosy headlines.

This would be a good time to remind readers that it is blockchain - not the government - that is the consummate source of truth. Hence, if you trade on economic data, the greatest present you can give yourself this holiday season is the gift of economic truth found at Truflation.

Unlike government sourced data - which is manipulated to fit political narratives and is based on an antiquated and painstakingly slow collection process - Truflation uses blockchain innovation to ensure the most unbiased, accurate and up-to-the-minute inflation information. (In case you missed it, check out this Decent Millionaire podcast episode with Truflation founder, Stefan Rust).

Even though short-term profits could very well be made by relying on faulty data, the real wealth will be amassed by those who elicit truth. Accordingly, I am convinced that the best way to make money in 2024’s farcical markets would be to trade like a conformist but invest like a truther. And the only way to do that is by using both conventional as well as blockchain data sets.

PREDICTION #4 - THE SEC’S DAYS ARE NUMBERED

I see people tweeting (or X-ing if that’s what the kids are now calling it) that Gary Gensler’s days at the SEC are numbered. If you ask me, I think that these Tweeters (or X-ers) are failing to see the forest.

It is not only Gensler’s job that is at risk. Thanks to those possessing the grit to stand up to heavy-handed regulators, the entire Securities & Exchange Commission (if not all overreaching agencies) - are now imperiled.

While I had predicted that 2023 would be a challenging year for the SEC, I never imagined that the shellacking it received in its lawsuit against Ripple would be just the very tip of the iceberg. Following the ruling that Ripple’s secondary exchange-traded cryptocurrencies are not securities, the Commission’s legal troubles only mounted.

Most recently, the SEC was seen groveling for forgiveness and begging not be sanctioned for making false and misleading representations to a federal court in the Debt Box case. And soon the Supreme Court of the United States will rule on the constitutionality of enforcement proceedings with administrative law judges (“ALJs”), the adjudication process that allows the SEC and other federal agencies to bypass a defendant’s constitutional right to a trial by jury (see ICAN amicus brief filed in the SEC V. Jarkesy case).

Because administrative law judges essentially allow the government to serve as the prosecutor, judge and jury, it should come as no surprise to learn that the SEC’s success rate is notably higher in cases brought before its ALJs.

A Supreme Court ruling in favor of Jarkesy would most certainly bring down the regulator’s batting average as well as make it much more difficult to rule by enforcement and to compel settlement payments.

But what I find most troubling is why a government agency, bringing cases backed by solid evidence and sound legal theories, would need an adjudication advantage at all.

Agencies, acting in good faith and in pursuit of true justice, do not use lawfare to establish rules. They do not conceal internal documents or misrepresent facts when trying cases. They do not waste time and taxpayer resources pursuing victimless cases. And they most certainly do not need to circumvent jury trials in order to secure legal victories.

Only a flagging agency in fear of losing power - whether to innovation or to the people it is supposed to serve - would need to rely on stacked courts and legal tactics to score litigation wins.

While it won’t be in 2024, I do believe that we are witnessing the gradual passing of the depression-born securities agency that has long lost its purpose and outlived its usefulness.

Even if the Securities and Exchange Commission is somehow able to rebuild its reputation, it has proven to be incapable of keeping pace with innovation. Hence, the 90-year-old agency will never be able to promptly regulate hi-tech modern assets that are evolving at breakneck speeds. Under these circumstances, I stand by my prediction that the SEC will cease to exist in the not too distant future. In fact, I don’t think that the agency will even live to see its 100th birthday.

PREDICTION #5 - SMALL RETAIL INVESTORS AND CRYPTOCURRENCY EXCHANGES WILL BE IN THE SEC’S CROSSHAIRS

Do not expect the SEC to go down without a fight. Nothing will deter the regulator from what has so obviously become its core objective: to keep retail investors from fostering the proliferation of financial innovation.

You can bet, that before it is dismantled, the SEC will do everything it can to block everyday Americans from accessing cryptocurrencies - as evidenced by the SEC’s latest attempts to amend its accredited investor definition as well as bolster its enforcement activity against cryptocurrency exchanges.

Indeed, Gensler’s SEC has been hard at work trying to undo the great strides the Commission made in broadening retail access to alternative products under the previous chairman. Instead of furthering the 2020 momentum of expanding the accredited investor definition to include those with professional knowledge, experience or certifications, Gensler has been trying to find ways to narrow the definition so that a much smaller pool of Americans would qualify as accredited investors.

In its latest report, despite acknowledging that its stringent accredited investor requirements already disproportionately harm minorities, the SEC is hinting at raising the criteria, even more, by excluding retirement assets from net worth calculations as well as increasing the income and wealth thresholds to adjust for inflation going forward.

The SEC estimates that the percentage of U.S. households, which meet the accredited investor standard, will surge from 18% to 31% by 2032 due to rising inflation - the very same inflation that the government assures us is so under control that the Fed is expected to cut rates sooner than anticipated.

Yes, you read that correctly. Apparently, according to this government, inflation is only problematic when it equates to 72% more American households possessing the freedom to invest their own money where they like.

Mark my words: this government will stop at nothing to prevent nearly a third of American households from moving capital from underperforming, inflationary-risk prone Treasuries into higher yielding alternatives - or heaven forbid, cryptocurrencies.

One third of American household net worth presently amounts to approximately $50 trillion. Even if just 3% of that found its way to cryptocurrencies, the entire cryptocurrency market would nearly double.

Because restricting unaccredited investors will not be enough to damage the cryptocurrency market, the SEC will also need to ramp up its enforcement activity in 2024. However, thanks to its embarrassing defeat in the Ripple case, the SEC will be hamstringed to go after singular cryptocurrencies.

Instead, I believe the regulator will shift its enforcement attention to what it sees as lower hanging fruit. And it appears that cryptocurrency exchanges have become the apples on the ground.

Well, except for Promethium, an obscure Chinese-funded crypto platform - with no history of trading crypto assets - that somehow recently received a special license to clear and settle crypto assets. For some inexplicable reason, Promethium seems to have nestled itself in some very high branches.

I expect that, in 2024, the SEC will steal a page from its usual playbook to target cryptocurrency exchanges, save Promethium.

Holding Promethium up as the exemplar, the SEC will urge cryptocurrency exchanges to apply for a special purpose broker-dealer (SPBD) license, claiming that there is a compliant path! However, in what has become the SEC’s modus operandi, the regulator will make sure to indefinitely withhold any qualifications. It will then attempt to sue, ideally in its kangaroo court, every cryptocurrency exchange for operating without an ATS or SPBD license. Familiar game - different mark.

It is worth mentioning that Promethium’s origin story - going from an industry unknown to an overnight sensation - feels eerily reminiscent to the sudden emergence of FTX, a criminal enterprise that masqueraded as a centralized cryptocurrency exchange.

As much as Elizabeth Warren and ilk would like people to believe, the FTX fraud is in no way reflective of the cryptocurrency industry - particularly since FTX wasn’t even a cryptocurrency exchange. It was more of a money laundering apparatus that redirected customer funds to swindlers, politicians and their Super PACS.

Remember, it wasn’t the government’s SEC that uncovered the FTX sham, it was FTX’s collapse that unmasked government shenanigans and exposed the vulnerabilities of centralized finance.

PREDICTION #6 - ELIZABETH WARREN WILL LOSE HER RE-ELECTION BID TO A PRO-CRYPTO CANDIDATE

While I am on the topic of Senator Warren, I am going to go out on a limb with a prediction that Warren will lose her 2024 election bid to a more crypto-friendly candidate - one who not only has an actual understanding of blockchain and basic economics, but one who is not looking to confiscate our wealth and financial freedoms through CBDCs (Central Bank Digital Currencies).

Under the guise of protection, Elizabeth Warren seeks to ban U.S. citizens from buying cryptocurrencies. Once upon a time, there were other Massachusetts-based government officials who, too, tried to “protect” its residents from a “dangerous” asset known as the Apple IPO.

Apple’s stock was so perilous that those outside of Massachusetts, who invested in its IPO, became multi-millionaires. A $10,000 investment into Apple’s bloodcurdling IPO is today worth over $19 million. Granted, $19 million is not nearly as much as Elizabeth Warren has amassed while working in government, but it is still not chump change.

Be leery of lawmakers, like Elizabeth Warren, who decree outperforming assets like bitcoin and hot IPOs as hazardous while deeming their devaluating currency and ebbing Treasuries as “risk free.” These people are not trying to help you protect your wealth, they are trying to assure theirs.

PREDICTION #7 - A FINTECH IPO COULD IGNITE AN ECONOMIC SURGE AKIN TO THE COMPUTER AND INTERNET INSPIRED BOOMS OF THE 1980s AND 1990s

Speaking of IPOs, as the fake economy and hoodwinked markets flourish in 2024, I would expect a much better year for initial public offerings.

IPOs are not just pivotal events in an individual company’s life, every once in a while, one comes along that changes the course of humanity and fuels unprecedented economic growth in the process.

Intel’s IPO launched the computer age while delivering extraordinary investment returns - including to small retail investors. (Click here for a firsthand account of Intel’s historic IPO). Netscape was another epoch-making IPO that ignited the internet revolution and the prosperous 1990s.

There is one possible IPO that I believe could power an economic surge akin to the PC and internet inspired economic booms of the 1980s and 1990s - and that is the IPO of a fintech unicorn called, Plaid.

Much like how Intel and Netscape gave rise to behemoths like Apple and Amazon, respectively, Plaid lays the foundation for world-altering consumer fintech businesses to be built upon.

If you are one of the 88% of U.S. consumers using fintech then you are probably already engaging with Plaid without even realizing it. Plaid powers thousands of the most widely used fintech apps and connects with more than 11,000 financial institutions from around the world, bridging the worlds of conventional and modern finance.

Most recently valued at $13 billion in 2021, Plaid recently hired a new Chief Financial Officer, and is reportedly eyeing an IPO.

A successful Plaid IPO could very well usher in a wave of fintech IPOs - not to mention, spark renewed VC interest in innovative fintech startups.

A Plaid IPO, coupled with record amounts of dry powder (committed but unallocated capital on hand at venture capital firms), could make 2024 one of the best years yet for fintech innovations to secure funding.

Because this is the exact type of breeding ground that engenders real economic growth - not merely journalistic representations of an expanding economy - the Plaid IPO may just turn out to be the catalyst that gets America’s wealth creation spigots running again.

PREDICTION #8 - MEDIA AND ENTERTAINMENT WILL EXPAND THROUGH UNCONVENTIONAL MERGERS AND ACQUISITIONS

Between X, Spotify, new independent networks, and another streaming service seemingly launching every minute, there is presently no shortage of video content.

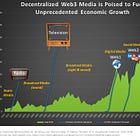

Additionally, with web3 media on the cusp of shifting both the power dynamics and economics away from the media moguls, and with political candidates discovering more fruitful ways to engage prospective voters, it is becoming increasingly more challenging for conventional media and entertainment enterprises to sustain themselves on traditional advertising and subscription revenue - even during a lucrative election season.

In light of these monumental transformations in mass media, I foresee legacy media and entertainment maintaining both relevancy and profitability through M&A activity. Although it wouldn’t be surprising to see the merging of streaming services, I believe that much more creative types of unions will ensue - ones that allow conventional media and entertainment businesses to completely reinvent themselves, enhance user engagement as well as unlock uncustomary new revenue streams.

For example, I can easily envision a streaming service or social media company acquiring a web3 media platform in order to enable its users to share in profits as both content consumers as well as creators. I can also visualize a production company or streaming service merging with a restaurant or hotel business that provides subscribers with real life interactions. Imagine, viewers of FX’s, The Bear, eating at a real-life replica of Carmine’s restaurant; or fans of The Marvelous Mrs. Maisel staying at a 1960s-theme hotel in New York City. The possibilities are only limited by imagination.

PREDICTION #9 - THE FATE OF HUMANITY WILL BE DECIDED BY WHO CONTROLS ARTIFICIAL INTELLIGENCE

I hear many people voicing concerns about artificial intelligence (AI). Technology doesn’t scare me. However, who controls that technology very much does. As long as technology, even AI, can be housed on a decentralized blockchain there is nothing to fear. That is why bitcoin, a digital asset on decentralized ledger, ensures financial freedom while a digital dollar (aka, a CBDC), on a centralized government-controlled blockchain, is the utmost threat to humanity since the invention of the atomic bomb. Although both assets employ blockchain technology, only the one that is centrally controlled is calamitous.

The greatest battle of our time is the one brewing between the centralists and decentralists. But don’t worry. Here’s how the good guys will prevail.

PREDICTION #10 - BITCOIN WILL REACH $120,000 IN 2024

Although it is tempting, I am not going to shy away from making a big and very specific bitcoin price forecast. I predict that the price of bitcoin will reach $120,000 in 2024.

This price forecast is not based on the qualification of a spot ETF which is very likely to be imminent. Nor is it based on the upcoming bitcoin halving which will, too, provide a bump. Instead, my $120,000 price target is based on a very vivid dream I had on December 7, 2023.

I also recently dreamt that I met a person who turned into a meatball - so you may want to take this prediction with a grain of salt.

And with that, I will conclude this year’s forecast.

Please know that this is all in good fun. I do not own a crystal ball or a DeLorean with a Flux Capacitor. However, in full disclosure, I may or may not be in possession of Louise's magical amulet necklace from the classic film, Teen Witch, which may or may not have some real magical powers.

I also hope that this article didn’t offend anyone - especially not the omnipotent government. I don’t hate you. I just think you can do a much better job of serving the people.

No offense either to Paul Krugman who, in the 1990s, shortsightedly predicted that “by 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.” Although I am obviously not a fan of Mr. Krugman’s Keynesian workarounds, I am eager to start my Krugman Exercise Program in 2024.

I am also very excited to share some big announcements, in the new year, related to DWealth Education, the Learn2Earn platform where individuals and business professionals get compensated for learning about modern finance.

So, stay tuned…

Until then, I’d like to wish everyone a very happy, healthy and prosperous 2024.

CHECK OUT PREVIOUS ANNUAL PREDICTIONS ARTICLES:

2022 Predictions So Obvious They Should be Called, Certitudes

Recap of 2020 Bizarro World and Some Really Bold Investment Predictions for 2021

How 2019 FinTech Trends May Have Laid the Groundwork for Another Roaring Twenties

Top 10 Lessons of 2017 and Some Very Bold FinTech Predictions

How 2016 Reshaped Financial Services for Generations to Come

The 2016 Predictions of a Self-Proclaimed Crowdfinance Semi-Clairvoyant

The 2015 Predictions of a Self-Proclaimed Crowdfinance Clairvoyant

2014 Predictions that will Solidify Crowdfinance’s Place in Wall Street History

The Evolving Capital Markets – 2011 Revisited, 2012 Forecasted

Decent Millionaire posts referenced in this article: