There are presently about 4,200 U.S. listed companies - about half as many as there were in 1996 when it was far more affordable and less regulatorily cumbersome to be a publicly-traded company.

There are also approximately 500,000 unique corporate bonds in the U.S. - most are byproducts of those 4,200 remaining listed companies.

There are also 27,699 different mutual funds and ETFs that are bought and sold in the U.S. - many of which are also byproducts of the same 4,200 listed companies.

Of the 27,699 fund options, very few offer exposure to alternative asset classes. In fact, only 153 funds are actually categorized as “alternative” and only 57 have a cryptocurrency or digital asset focus.

Out of the 57 digital asset focused funds, only about a handful have been qualified by the Securities and Exchange Commission. The rest are only available to accredited investors - those possessing a net worth of over $1 million, excluding one’s personal residence, or make over $200,000 (individually) or $300,000 (with spouse or partner).

None of the SEC qualified crypto funds are able to hold actual cryptocurrencies. Instead, they consist only of crypto futures contracts or stocks of companies and other ETFs with exposure to cryptocurrency.

And since none of the SEC-sanctioned digital asset funds are “no-load funds” (sold without a commission or sales charge), Americans interested in diversifying with digital asset funds, are forced to pay additional fees just for the privilege of holding crypto funds that are completely devoid of actual cryptocurrencies.

With 131.2 million households in the U.S., the above asset universe equates to less than one investable product per American household.

Less than one.

And since most of those aforementioned assets share DNA with the same 4,200 listed companies, Americans’ investment portfolios are woefully under-diversified and completely unprotected from today’s challenging economic conditions.

To make matters worse, the dearth of ample investable assets make it difficult, if not impossible, for many alternative products to endure as safe haven investments.

In fact, in recent years, many alternative assets have become more correlated to traditional assets. As correlation increases, the effectiveness of those alternatives to serve as portfolio diversifiers diminishes.

Even bitcoin, a once highly uncorrelated asset to equities, has begun to trade more in synch with stocks - particularly since early 2021 when bitcoin FOMO (Fear Of Missing Out) began spreading across the institutional investor community and fund managers started simultaneously adding the crypto bellwether to their portfolios.

Long before the institutional bitcoin FOMO contagion, stocks and bitcoin traded completely independently of one another. Fund managers couldn’t care less that techies and college kids were buying bitcoin to pay for pizzas and weed. And even when those techies and college kids were becoming bitcoin millionaires, in the later part of the last decade, many institutional investors were still dismissing bitcoin, labeling it a fad or rat poison squared (the latter of which was so ridiculous that it has since become a term of adulation).

But once that “fad” surpassed a trillion dollars in market capitalization in early 2021, even many institutional crypto skeptics jumped on the bitcoin bandwagon. And it was precisely during this time that bitcoin’s correlation to stocks began to spike. In fact, according to a recent study from Georgetown University, the correlation between bitcoin and the S&P500 increased over 312% starting in early 2021.

More recently, as the stock market was declining on rising inflation, bitcoin was also trading down – despite bitcoin having all of the markers of being a good hedge against inflation.

It is not difficult to understand why institutional adoption has become a harbinger for asset correlation. For the most part, institutions all use the identical investing playbook. They all rely on the same economic data (whether accurate or not) as well as use similar trading algorithms. Hence, when stock markets are tanking, institutions, in tandem, tend to sell off other assets in their portfolio - not due to fundamentals, but simply to cover shortfalls in their equity positions.

Because most fund managers are unlikely to break from the institutional herd, the only sure fire way to prevent asset correlations from escalating is to introduce an ocean full of new and unrelated assets into the asset pool.

And this is where tokenized collectibles come in.

Collectibles such as art, wine, coins, baseball cards, toys, antiques, stamps, and books are superb portfolio diversifiers for many reasons. First, they share no genetics whatsoever with listed companies. In fact, collectibles have little correlation to even one another. Furthermore, collectibles have been known to provide solid appreciation over the years.

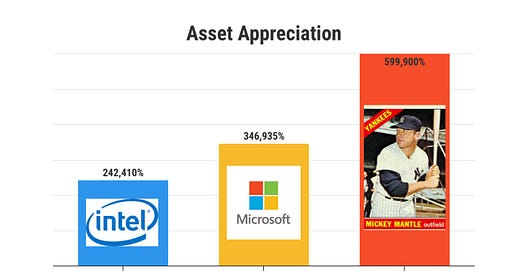

My cousin bought a 1964 Tops Mickey Mantle baseball card for $5 in 1979. That card is worth $30K today. That’s an incredible 599,900% return - even surpassing both Intel’s and Microsoft’s post IPO returns! And that Mickey Mantle card appreciated even during downturns in the stock and bond markets.

Rare wine is another collectible that has long been recognized by collectors and investors as a store of value with the potential to deliver impressive financial returns – sometimes even outperforming traditional assets like stocks or bonds over certain periods.

The problem was that until recently, collectibles such as these were not readily tradeable.

But thanks to asset tokenization, that is all changing.

Asset tokenization is a process that creates digital tokens on a blockchain that represent digital or physical assets which can then be sold on the secondary market - just like shares of a stock.

Asset tokenization enables us to turn every product under the sun – including rare collectibles - into liquid tradeable assets just like stocks. In doing so, it will create the most unprecedented portfolio diversification opportunity in the history of mankind!

Collectibles fall into the category of real-world assets (RWAs) that exist outside of the traditional financial system.

Bain Capital estimates the value of all private assets outside the financial system to be around $540 trillion - more than FIVE TIMES the present value of global assets under management. Bitcoin, even at its 2021 peak market cap of $1.28 trillion, was still only worth about 1% of global assets under management. So, while bitcoin’s impressive appreciation was able to provide individual portfolios with greater risk-adjusted returns, its relative market size was simply not big enough to prevent institutions from causing bitcoin’s correlation to stocks to increase.

But the tokenized asset is in a class by itself.

Unlike stocks which can take many years and cost millions of dollars to become publicly-traded, tokenized assets can be minted and tradeable within minutes and for a fraction of the cost. As such, asset tokenization will ensure that investors have an endlessly proliferating supply of diverse investable products to choose from.

By continuously adding this magnitude of unrelated investable assets into the mix, asset tokenization will ensure the diversification necessary to produce much greater risk-adjusted returns for all investors.

If you want to learn more about tokenized collectibles and asset tokenization in general, check out the recording of our recent wine tokenization webinar.