Decentralization will Shape the Future of Humanity

The 2023 Predictions of a Slightly Imperfect Clairvoyant

For years I have been publishing articles summarizing the closing year and forecasting the years to come. Most, but not all, of my predictions have come to fruition leading me to believe that I inherited a slightly flawed clairvoyant gene.

As I review last year’s predictions, I’m reminded of how imperfectly clairvoyant I am. After an impeccable predictions scorecard for 2021, 2022 had hits-and-misses.

I was spot-on in forecasting that in 2022 fintech would expand beyond banking and finance and into media, healthcare, education and governance. As detailed in my predictions section below, the innovation I am seeing in these categories is nothing short of epochal.

I also accurately forewarned that a concerted war would be waged against crypto. While I had indeed anticipated exceptional dip-buying opportunities ensuing from the regulatory and propaganda bullets being used to warn citizens of the “perils” of decentralized finance and cryptocurrencies, I underestimated the extent that these warmongers would go to thwart fintech innovation and financial democracy.

FTX appears to be additional arsenal in this collaborative war to take down crypto – or at the very least, slow down crypto’s progress so that “big fina” (big finance) could catch up. Frankly, the accounts that we are being fed about the rise and fall of FTX simply does not add up. It is implausible that a kid could emerge from thin air as an overnight multibillion-dollar industry sensation and land prominent speaking gigs with a former leader of the free world without very high-level assistance. This is an extraordinary PR feat for even the most eminent client, let alone for an unknown who spends most of his day, collecting imaginary gold and defeating make-believe enemies in a League of Legends game.

It is also suspect that every single one of FTX.com’s internet archives have been scrubbed from the WayBackMachine, and that Sam Bankman-Fried’s Wikipedia page does not point to even one article prior to 2021. Where are all of the pre-2021 archives referencing this genius philanthropist who was giving away money like it was candy (or taxpayer dollars)? Why is this story being told post facto?

Was FTX, as some are alleging, a PSYOP designed to demonstrate the dangers of cryptocurrency investing – all while laundering a couple of billion in fiat in the process? Is SBF a criminal mastermind or is he a patsy? Do criminal masterminds typically donate 99% of their gains to charity? It’s hard to imagine Dr. Evil holding the world hostage for one million dollars only to give $990,000 of it to GreenPeace.

Although these questions - no matter how farfetched they seem - warrant immediate answers, don’t be surprised if they get suppressed along with the remaining JFK files.

As for the rest of last year’s prognostications, I still stand by all of them. My timing may have been off, but I remain confident that the cryptocurrency market will ultimately soar to new heights and that digital assets will become a necessary and viable hedge against inflation, and more importantly, stagflation.

But timing, as they say, is everything - especially when it comes to market predictions. Last year’s enthusiastic price forecasts considerably missed the mark in 2022. All I can say is that sometimes my reputation, as an unabashed optimist, precedes me. Otherwise, I'd be late for all my appointments.

If anyone knows of a holistic remedy to curtail blockchain exuberance, please let me know. In the meantime, what I see unfolding in 2023 (and, more precisely, beyond) can be pretty much summed up in one word, decentralization.

PREDICTION #1: REGULATORS WILL CONTINUE TO STYMIE INNOVATION & ECONOMIC PROSPERITY WITH GRATUITOUS ENFORCEMENT

There is a major court ruling on the horizon that could send ripple effects (pun intended) across the cryptocurrency industry and beyond. This case - Securities and Exchange Commission v. Ripple Labs Inc. (1:20-cv-10832) - will not only decide whether or not Ripple’s native cryptocurrency, XRP, is a security falling under jurisdiction of the SEC, it could set new precedents in curbing the practice of “ruling by enforcement” which would have widespread effects on all future federal agency litigation. Most significantly, the Ripple decision could be a determinative factor in America’s ability to maintain her position as a leading global innovator and economic superpower.

The Ripple case is truly that consequential.

Should the SEC lose this landmark case, it will force Congress to pass meaningful legislation categorizing digital assets and creating a proper regulatory framework for blockchain-based financial innovations. Such regulatory clarity could prevent the U.S. from bleeding innovators to overseas jurisdictions, thereby restoring much needed capital and jobs to a nation struggling to tackle the simultaneous rising of inflation and unemployment. This predicament, known as stagflation, is particularly troublesome because the conventional Keynesian macroeconomic toolkit is utterly useless.

Unfortunately, I don’t see a regulatory framework for digital assets happening anytime soon in the U.S.

First of all, it is highly unlikely that the Ripple case will result in immediate closure. If the SEC was hoping to strongarm Ripple into a quick settlement which could then be exploited to set regulatory precedents, it sorely miscalculated and underestimated Ripple’s resolve. It’s also evident that the regulator never anticipated that its internal documents, acknowledging that certain cryptocurrencies are not securities, could be released to the public during the litigation – as the Commission is certainly going through great lengths to try to keep these records concealed.

With so much now invested on both sides, I wouldn’t be surprised to see the Ripple case eventually being held up in appeals. Furthermore, I don’t foresee the likelihood of a divided Washington coming to an agreement on digital asset legislation any time soon.

With the Ripple verdict and a clear regulatory framework hanging in the balance, I expect that the SEC will set its enforcement sights on lower hanging fruit such as DeFi, NFTs, and newer less capitalized decentralized innovations that lack sufficient resources to effectively defend against SEC overreach.

Fortunately, there are organizations like Investor Choice Advocates Network (ICAN), a nonprofit public interest law firm, that advocates for innovators and small investors. In addition to filing amicus briefs in high profile cases such as SEC V. Ripple, ICAN represents parties who cannot afford counsel in precedent setting SEC matters impacting barriers to entry to capital markets.

PREDICTION #2: THE DECENTRALIZED REVOLUTION WILL TRANSCEND THE DIGITAL TRANSFORMATION

Altruism is not the only force that will keep regulators in check. Decentralization, made possible by blockchain innovation, will gradually permeate into every facet of society including finance, business, media, entertainment, governance, education, economics and more. The list is truly endless.

This decentralized revolution will transcend the digital transformation that has been redefining the planet in recent decades.

Accordingly, in the long run, it really won’t matter how relentless regulators are in their attempts to overstep. Sooner or later, decentralization will prevail, and democracy will ensue. I realize that, looking around, it may feel like the opposite is true - as if the world is becoming increasingly totalitarian. But, I promise you that is not the case.

What we are witnessing, at this very moment in history, is humanity’s unassailable journey to egalitarianism. The fact that despotic roadblocks are being erected along the way only reinforces its inevitability, for there would be no need to set up barricades on a road to status quo.

Even those on the cusp of losing power are beginning to realize that their barriers will not alter the destination and that the best they can do is to try to decelerate the voyage. But, with decentralized innovation snowballing, there will come a point where even slowing down its progress will become futile. This is also known as the “then you win” phase of the famous Mahatma Gandhi quote.

Don’t despair. The more centralized and authoritarian society feels, the closer decentralization is to triumphing.

PREDICTION #3: HUMANITY’S EVOLUTION TO DECENTRALIZED FINANCE IS INEVITABLE

Finance will become decentralized. Full stop.

Although there will still be those who will stop at nothing to make sure that decentralized finance does not usurp the monopolistic financial power structure that has been place for the last 110 years, their efforts will prove futile.

If FTX was indeed some sort of a PSYOP intended to frustrate the advancement of cryptocurrencies, it was a dismal failure - as it appears, instead, to be hastening humanity’s evolution to decentralized finance. Rather than demonstrating the dangers of cryptocurrency investing, the FTX collapse has singlehandedly underscored the necessity of decentralized finance.

The fallout proves that centralized platforms, like FTX, are ripe for abuse while decentralized finance is far better at protecting investors against fraud.

The FTX lesson is simple: those who self-custodied their digital assets still have them whereas those who entrusted them to FTX do not. Perhaps, the solution is more education on ways to securely self-custody and less emphasis on retrofitting centralized structures for decentralized innovation.

PREDICTION #4: HUMANITY’S EVOLUTION TO DECENTRALIZED GOVERNANCE IS INEVITABLE

When it comes to running an organization – be it a business, a municipality or even a nation - the future of governance is decentralization. Fuller stop.

Decentralized Autonomous Organizations, known as DAOs, are blockchain-based organizational structures that are owned and run by its members who, via tokens, possess decision-making and/or economic rights in the organization.

This means that instead of one Chief Executive Officer or a few select bureaucrats, an entity can be effectively managed by the collective. Imagine the impact on healthcare if the policyholders of a health insurance company could help decide what treatments would be covered; or the impact on innovation if more individuals could impart intellectual capital to a project; or the impact on economics if one’s compensation was more accurately tied to one’s contribution; or the impact on education if students could help choose what subjects should be taught; or even the impact on politics if citizens could vote directly on a bill as opposed to entrusting an elected official to vote for them.

DAO governance can ensure that corporate values are more aligned with their consumers, that governments are truly governed “for the people by the people”, and that wealth is more fairly dispersed. Perhaps now you can understand why some are fighting so hard to resist decentralization.

Nevertheless, certain U.S. states as well as international jurisdictions are beginning to formally adopt DAO laws that recognize DAO structures and governance tools for business entities, and it is only a matter of time before the DAO structure predominates.

PREDICTION #5: HUMANITY’S EVOLUTION TO DECENTRALIZED MEDIA IS INEVITABLE

Media will become decentralized. Fullest stop.

You may have begun noticing the term, web3, being tossed around. Get ready to start hearing it much more in 2023, for it is the next progression of the internet. In the simplest terms, web3 is decentralized media. And its economic impact will be unprecedented.

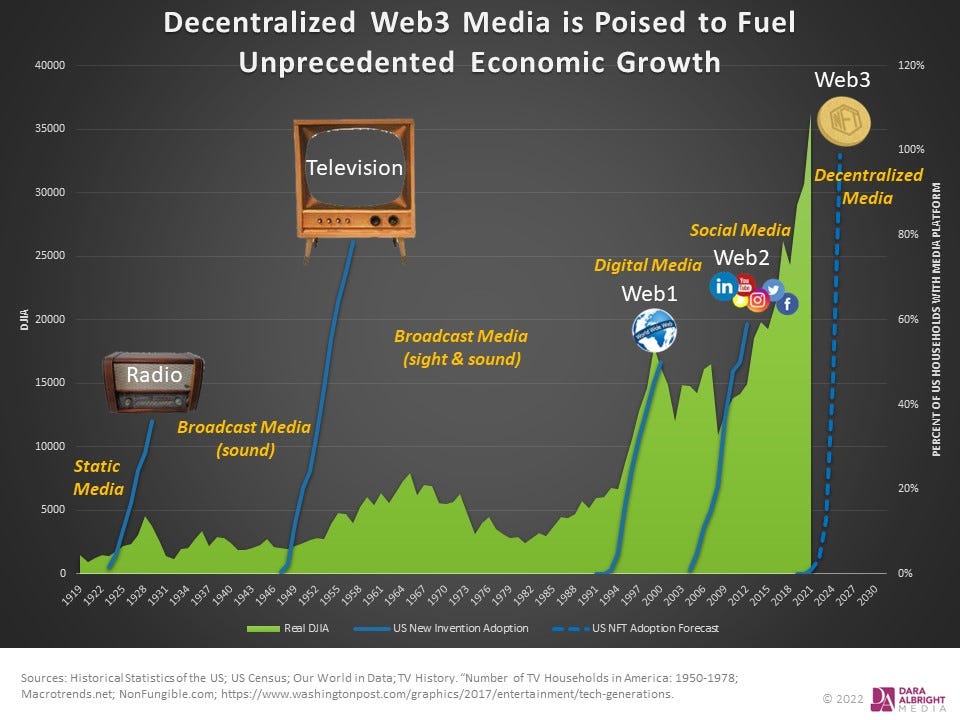

While not widely cited as a leading indicator of stock market growth and economic prosperity, but as the chart below certainly depicts, some of the greatest bull markets in history have all coincided with a new innovation in mass media.

But, web3 is special. The impact of radio, television, web1 and social media combined will pale in comparison to the imprint that web3 is about to impart onto the world. Web3 will mark the first time in history when a mass medium surfaced amid the tailwinds of an emergent decentralized financial system. Additionally, in all previous instances, consumers of new media have been both the customer as well as the product. However, with web3, consumers are now the producers and the payees. Never before have media consumers been on the receiving end of the financial transaction. Nor have they ever been afforded this much opportunity to share in the economic impact of media innovation.

For consumers, web3 will change the way that we all browse, stream, learn, create, share, exercise, shop and, most significantly, earn. However, for media and entertainment companies, web3 will completely upend centuries of traditional advertising revenue models.

Web3 allows consumers to either opt-out of seeing advertisements or be financially rewarded for accepting them. It enables consumers to be compensated for allowing companies to use their data for marketing purposes. To make a long story short, web3 will ensure that ad dollars are rerouted from big tech and Madison Avenue directly to the consumer.

Furthermore, web3 will empower more individuals to create and broadcast media and entertainment content. These will not be the amateur selfie videos of yesteryear. Technology has made it possible for the layperson to churn out very sophisticated content at production levels that would make even renowned filmmakers envious. If you thought blogging was disruptive to journalism or podcasting to radio, wait until you see full-length feature films, series programming, and even newscasts being successfully produced and widely distributed by anyone with nothing more than an idea and a cellphone.

Now that I think about it, we might as well add centralized tech, legacy media and entertainment moguls to the list of decentralized oppositionists.

PREDICTION #6: A BETTER MACROECONOMIC SOLUTION WILL EMERGE AS THE RESOLUTION TO KEYNESIAN FAILURES

In case Keynesian economists were feeling left out, they, too, will soon have membership cards to the Decentralized Oppositionists Club, for their entire macroeconomic theory is about to be replaced by a more egalitarian, GDP-accretive solution that, as an added bonus, will also help save America from a looming retirement-induced financial crisis that will make the 2008 global meltdown look like the roaring twenties (the 1920s, that is).

Decentralization and digitalization have given rise to an entirely new economic system, called Participate-2-Earn Economics (P2E Economics for short) that has already begun to pervade most major industry sectors including healthcare, retail, entertainment, media, marketing/adverting, education, business services, hospitality, and even energy.

This modern macroeconomic solution will completely obsolete Keynesian economics, the antiquated depression-era macroeconomic theory which has been weakening society with its ratifications of reckless spending and its failure to account for fintech innovation.

In a nutshell, P2E Economics leverages digital and decentralized innovation to enable individuals to be compensated for contributions that expand well beyond traditional labor and investment. Participants within the P2E economic ecosystem receive remuneration simply by partaking in routine activities such as learning, exercising, playing, surfing the web, recommending products to friends, viewing video content, and most significantly, shopping.

There are even innovative P2E models emerging in the business world. A great exemplar is the CryptoOracle Collective, a decentralized web3 advisory service that allows participants to earn while sharing expertise. In doing so, the CryptoOracle Collective can enable more people to work in web3 while simultaneously solving an industry-wide issue of illiquid tokens and equity. This model could be an utter gamechanger to capital formation.

With P2E, individuals are easily able to earn hundreds of dollars per month without altering their daily behaviors. It is important to note that I am not talking about the unsound “pyramid-esque” play-to-earn schemes that we have seen in the recent past. I’m talking about an entirely new generation of Participate-2-Earn projects that are backed by real world assets.

Perfect examples of this more sustainable P2E paradigm include Health Hero, an innovative Health-2-Earn company that incentivizes users for staying healthy as well as Worthy Financial, a novel Shop-2-Earn fintech company. Health Hero has designed a long-term, supportable pricing support system for its token that taps into $15B+ of healthcare-related real world assets. And, Worthy enables its users to earn a fixed 5% annual return by investing their “spare change” - accumulated via Worthy’s round-up app -into real estate projects.

P2E Economics allows every single inhabitant of a nation - even its most impoverished - to build ample retirement portfolios - all while obtaining knowledge, improving their health and, most significantly, without triggering a macroeconomic quandary that Keynesian’s refer to as leakage.

P2E Economics has the potential to resolve all of America's retirement challenges without forsaking the consumption necessary to expand GDP, and without policymakers having to raise the retirement age, increase payroll taxes, cut promised retirement benefits, or even disrupt existing retirement plans.

Be that as it may, mending a broken retirement system is just the tip of the iceberg. P2E Economics is the cure to today’s economic problems and decades of Keynesian failures. It holds the promise of fostering economic growth, narrowing wealth gaps, raising national literacy rates, lifting millions from poverty and improving the physical wellbeing of the masses.

Prediction #7: HODLERS & HOARDERS WILL BE REWARDED

2022 was a tough year for investors – especially cryptocurrency investors. That said, nothing that transpired this past year has shattered my confidence in the future of the cryptocurrency market. If anything, 2022 has only fueled my conviction in its upside potential.

Let me be very clear. Nothing – not crypto winters, not collapsed token exchanges, not ponzi-schemes, not media admonishments, not decentralized obstructionists, nor even cheeky titled congressional hearings labeled to intimate the hazards of crypto - will stop the cryptocurrency market from ultimately reaching new all-time highs.

How can I be so sure?

Because every day I am introduced to another extraordinary web3 venture that is implementing blockchain innovation to improve lives and benefit society. As sure as the sun will rise, the crypto network will expand, for each one of these projects produce exponentially more crypto users.

Today, only 4.2% of the global population owns cryptocurrencies. To put this figure into perspective, crypto is where the internet was in 1999 in terms of adoption. By 2004, global internet users quadrupled – even as the dot com bubble burst and wiped out trillions of dollars in market value.

People didn’t stop logging on to the WWW when NASDAQ crashed in 2000, nor will society rebuff blockchain due to a collapse in the cryptocurrency market.

An analogous growth trajectory to the internet would yield a little over a billion crypto users by 2027. However, given today’s much lower entry barriers to both innovation and education, I have no reason to doubt that crypto’s user growth rate will far surpass that of the internet.

Two decades ago, the internet was extremely slow and broadband was expensive - if not, impossible for many - to access. In fact, less than 1% of the world had broadband access in 2001. By comparison, 6.648 billion people, today, already own a smartphone. That’s 83% of the world’s population with an existing gateway to the world of cryptocurrencies and crypto education! (BankMyCell, OurWorldinData)

Furthermore, not only are more and more quality educational resources emerging online for the masses to learn about how blockchain innovation is reshaping industries, businesses, personal finance and civilization at large, decentralization is set to make sure that much of this educational content is instantaneously monetizable.

With accessibility to technology and knowledge no longer an impediment, with more businesses making the leap to web3, and with Participate-2-Earn ventures continuing to propagate, there has never been a more opportune moment for wealth creation – especially for those who lack the means for traditional investing.

So, keep HODLing. Keep hoarding. And, most of all, start participating. The dawn of decentralization is upon us. And it is here to stay – at least for the next few centuries.

In fact, I am so confident that the future of humanity lies with decentralization that I have decided to bank my entire career on it. Beginning in 2023, I will podcasting under a new brand, the Decent Millionaire Podcast - short for Decentralized Millionaire and representative of both the decent wealth generating potential as well as the overall decency that I believe decentralization will beget.

Between the Decent Millionaire Podcast and our Learn-2-Earn platform, which will be officially launching in 2023, I look forward to teaching the advantages of P2E Economics, and to helping people - of all ages and across all walks of life - discover how decentralization and web3 will make them healthier, wealthier and wiser.

Here’s to a happy, healthy, prosperous and an abundantly decent 2023 for all!