Why Does Biden Oppose Investing Freedoms for Everyday Americans?

Recent Statements from the White House and the SEC Chairman Indicate Strong Opposition to the Accredited Investor Definition Becoming More Inclusive

Anyone, who has been reading my articles and research papers over the years, knows how passionate I am about amending, if not abolishing, the accredited investor rule so that all Americans are given the freedom to invest their own money where and how they choose.

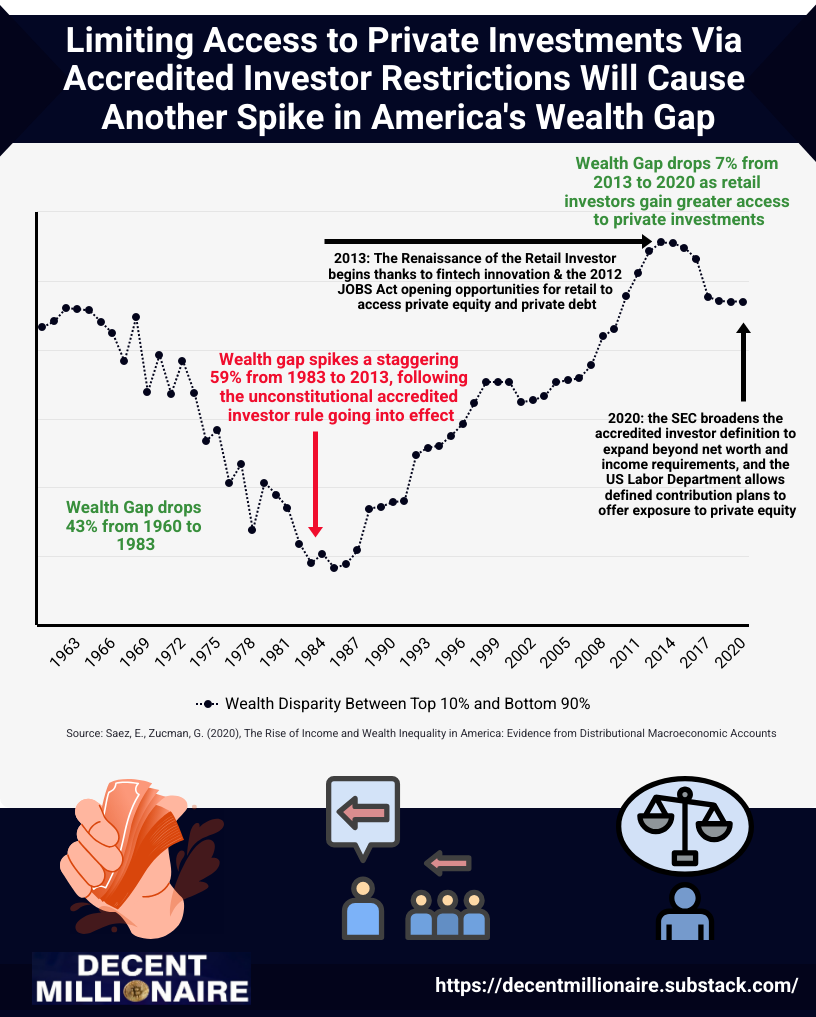

Ever since the accredited investor status became an appanage of the investing elite, America’s wealth disparity has escalated to unprecedented levels.

Read my 2018 article, published in RealAssets Adviser Magazine, detailing how fintech and regtech have been working to narrow America’s wealth gap: Renaissance of the retail investor: Individual investors are about to play a much bigger role in the investment industry

It doesn’t take a economic genius to figure out that national wealth gaps will intensify when politicians deny lower and middle class citizens the same wealth building opportunities afforded to its upper class.

Nor does it take an investment wiz to know that money accrues when it is invested in assets before they appreciate - not after. I mean even legislators, who can’t seem to balance a budget, understand the fundamental concept of buying low and selling high.

Despite this knowledge, those with governmental power, have cultivated a capital markets system that literally forces the vast majority of its citizens into buying high and, very often, selling low.

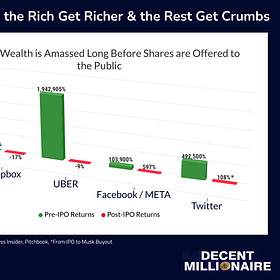

Because onerous and costly regulations make it nearly impossible for small emerging businesses to thrive as publicly-traded companies, today’s most promising ventures wait until after they have already ballooned to multi-billions of dollars in market capitalization to list on a public stock exchange.

Because these companies are mushrooming in the private markets where only accredited investors can partake in their peak growth, most - if not all - of their appreciation occurs in the coffers of venture capitalists instead of in the retirement portfolios of everyday Americans.

By assuring that only accredited investors are allowed to invest in these privately held pre-appreciated businesses, the government has forced its serfs lower and middle class citizens into serving as the exit strategy for America’s financially privileged.

This is not some new revelation.

Government officials are well aware that the unjust accredited investor definition is not only disproportionately harmful to minorities, but also a deterrent to economic growth, job creation and innovation.

One doesn’t have to look any further than to the myriad of comment letters informing the SEC of the economic perils should further restrictions be made to the accredited investors definition.

Given the countless documented warnings, it begs the question, why are Biden and his SEC so hell-bent on curtailing the number of accredited investors? I mean, with this much of a paper trail, it’s not like they’ll ever be able to legitimately claim plausible deniability.

Do they not care about the broader economic consequences - let alone their personal political careers?

There is no valid explanation for why the White House would “strongly oppose the passage of H.R. 2799,” a bill, just passed by the House, which would allow many more individuals to qualify as accredited investors.

This legislation, sponsored by Congressman Patrick McHenry, Chairman of the House Financial Services Committee and known in fintech circles for his equity crowdfunding advocacy, would add clients of registered advisors to the definition of accredited investors - provided they do not invest more than 10% of their net worth or gross income into private securities.

Although, I don’t believe that a government should ever have the authority to cap the size of an individual’s personal investment, McHenry’s bill is a step in the right direction in that it could add tens of millions more individuals to the elite accredited investor club - well more than doubling its current size - and in the process bring hundreds of billions of dollars to job creators and to transformative innovations such as renewable energy.

It seems illogical that an administration, overseeing a struggling economy and claiming to prioritize equity and greener energy solutions, would repel a bill that would foster economic growth and advance its core agenda.

Nor does it make sense that this regime’s SEC Chairman would have the audacity to question whether accredited investor exceptions are warranted at all.

At a recent Small Business Capital Formation Advisory Committee meeting, SEC Chairman Gary Gensler flat out stated, “Any discussion about the definition of an accredited investor raises the question about when it may be appropriate to have exceptions to this basic bargain at the heart of our capital markets. In essence, when is it appropriate that investors get—or not get—that full, fair, and truthful disclosure that President Franklin Roosevelt worked with Congress to embed in the securities laws?”

Gensler’s remarks make it clear that he not only wants to reduce the number of accredited investors, he wants to outright eliminate them!

But Gensler doesn’t just stop at calls to condemn accredited investors to a life of investing servitude, he also has the audacity to accuse private issuers of being unscrupulous.

I don’t recall Peter Thiel complaining about Mark Zuckerberg’s lack of public disclosures while making more than a billion dollars and over a 2,000,000% return on his venture investment into Facebook. Nor can I remember hearing any other accredited investors crying foul when they were realizing over 40,000% on their money from selling their pre-IPO UBER and Dropbox shares to retail investors.

Despite Gensler’s defamatory assertions, businesses do not raise private capital in order to deceive investors. They do it because going public too early would subject their companies to abusive short sellers, limit their future financing options and impede their growth - which, in turn, would accomplish nothing but stifle job creation and decimate retirement portfolios. These truths denote a deep-seated failure in market structure - not a reflection on the thousands of upstanding entrepreneurs who raise private capital each year.

No, America’s emerging companies are not the ones hurting investors. Mr. Gensler needs to look no further than his own mirror to identify the true source of investor harm.

Gensler uses the full power of his enforcement arm to prosecute companies for what Gensler (not Congress) deems to be unregistered securities offerings - without any regard to the damage he is causing all of those with a vested interest in the growth of these businesses. This type of government lawfare not only bankrupts innocent businesses, causes layoffs and thwarts innovation, it injures the investors who, prior to the SEC interfering, were unscathed and without grievances.

Under the Gensler reign, the SEC is failing at its core mission to protect investors. Instead, and to the detriment of the nation, the regulator’s only successes appear to be in churning out victims.

Until something changes, so long as this government views private issuers as criminals and their investors as prey, accredited investor restrictions will continue to exploit smaller investors, suppress economic growth and exacerbate America’s wealth gap.

I am excited to announce that in the coming weeks DWealth Education will be launching new educational initiatives designed to ensure that all Americans have the ability to invest their own money where and how they choose. Subscribe below to receive updates.

I also encourage you to visit ICANLaw.org to learn about the noble work that Investor Choice Advocates Network (ICAN) is doing to break down barriers of entry to capital markets and push back against SEC overreach.

Related Articles:

Why Americans Should be Cheering the Labor Department’s Recent Move to Open 401(k) Access to Private Equity

Last month, in a judicious move, the US Department of Labor (DOL) announced intentions to allow defined contribution plans to offer its participants exposure to private equity investment opportunities. Although democratizing access to investment products and fostering asset class diversification will accomplish more to narrow the national wealth gap and …

A Bill Just Passed the House that Could Have Epic Implications for Fintech and Cryptocurrencies

A bill that would have epic implications for fintech - cryptocurrencies in particular - just passed the House by an overwhelming bi-partisan majority of 383-18. And barely anyone in the fintech industry is even talking about it. H.R. 2797, also known as the Equal Opportunity for All Investors Act, would permit all Americans, regardless of economic status…

Some Brassy, Perhaps Offbeat, Financial Forecasts for a Wildly Unpredictable 2024

Tis the season to be prognostic. That time of year when I get to evaluate my previous predictions as well as channel my inner prescient powers to see what lies ahead. Last year’s article, which envisioned how decentralized innovation will shape humanity, was probably one of the most prophetic articles I had ever written. Everything foretold has either co…