Blockchain and Fintech Innovation will Save America from Purchasing Power Erosion

And Protect Americans From Today's Little Red Riding Hood Economy

Those who have read my 2024 predictions post know that I’m on the Paul Krugman exercise regimen where I do 100 sit-ups, 50 jumping jacks and 5 minutes of planking every time Paul Krugman publishes an article lauding the U.S. economy. Thanks to Mr. Krugman, I expect to have washboard abs by the time the summer arrives.

One month into the new year and I am already well on my way to reclaiming the physique I had in 2003 - all due to Paul Krugman’s desperate attempts to convince the public not to believe their lying eyes as they deplete their savings to pay more money for less items - including their food!

Average American purchasing power has been eroded by 22.31% since Jan 2020, according to Truflation, publisher of the first daily, unbiased, real-market inflation and economic data. And that doesn’t even account for “shrinkflation,” a term used to describe the reduction in size of consumer products - like less chips in a bag or fewer squares on your toilet paper roll.

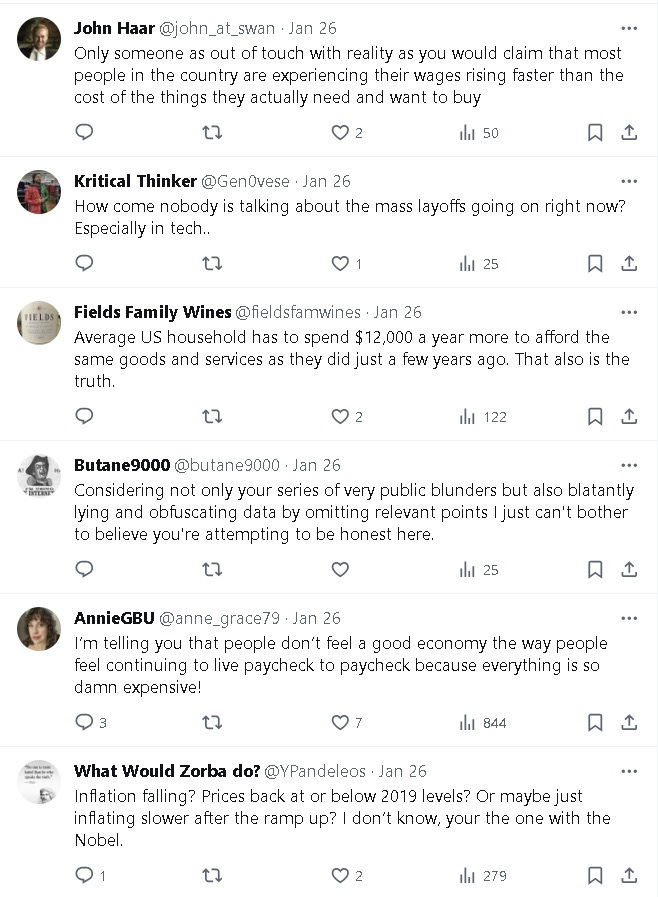

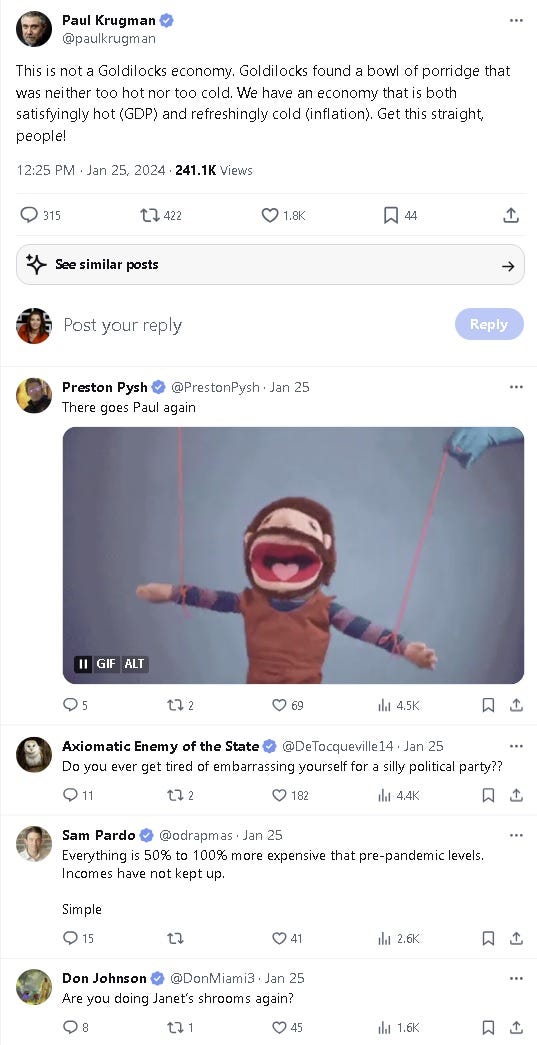

Despite the harsh economic reality, Krugman continues to extol an economy that is declining far faster than ancient Rome's.

Reading Krugman’s X feed, one would think that America is presently experiencing one of the greatest economic expansions since the internet-created boom of the 1990s.

According to a recent tweet by Paul-the-Internet’s-impact-on-the-economy-will-be-no-greater-than-the-fax machine’s-Krugman, “So 2023 was a miraculous year for the economy: high growth with inflation falling all the way back to the Fed's target, rising real wages . . .”

However, if you read through some of the responses, you’ll see that the people aren’t exactly living in Krugman’s economic utopia.

Nor are people buying into Krugman’s fairytale that today’s economy transcends even the idealistic Goldilocks economy.

Although Krugman’s condescending tweet is correct in that this is no Goldilocks economy, I believe that there is another fable that more accurately depicts the present economic environment. I call it, “The Little Red Riding Hood Economy.”

The Little Red Riding Hood economy is one where consumers and retail investors are being deceived by a Big Bad Wolf whose true intent is to swallow their financial resources whole.

The Big Bad Wolf has a sordid history of restricting smaller investors from amassing wealth by prohibiting them from investing in higher yielding alternative investment products. However, since banning investment access, alone, will never amount to nearly enough wealth to satiate the Big Bad Wolf, more devious measures need to be taken.

And what better way for the Big Bad Wolf to devour the remaining financial resources of others than by caballing them into spending more and saving less?

In fact, because consumption makes up more than 70% of GDP, getting consumers to spend more and save less just so happens to be the very goal of every Keynesian economist like Paul Krugman.

Unfortunately, while this spend more / save less mindset has benefited an elite few like Mr. Krugman, it has been detrimental to the majority of Americans who can now barely afford a $1,000 emergency, or to the growing number of America’s seniors who are falling below the poverty line.

Although, unconstrained government spending has unleashed unprecedented inflation in recent years, it has been the decades of forsaking saving for consumption which has now led to a self-inflicted retirement crisis that, without a viable solution, will cause an economic collapse that will make the 2008 financial meltdown look like the roaring 1920s.

Thankfully, just like in the 1990s, innovation will save the masses from financial devastation – not to mention, from a wolf in grandma’s clothing.

Modern blockchain and fintech innovation are delivering much more effective ways for individuals to earn, invest, save, and even to conquer inflation. As a result, everyone – no matter their present financial condition – will be able to outpace escalating costs of living and improve their retirement outcomes.

Feel free to join us for a very special complimentary Learn2Earn webinar, on February 20th, where you can be compensated while learning how blockchain and fintech can be used to protect your money as well as enable you to build a nest egg - even during these challenging economic conditions.