2022 Predictions So Obvious They Should be Called, Certitudes

For many, tis the season to be jolly. But for me, tis the season to be gloating about my 2021 predictions as every single one of my last year’s forecasts have so far come to fruition.

Either I am A) truly clairvoyant or B) the signs have simply become that obvious.

While I like to believe that I do have some sort of prophetic energy running through my blood, the reality is that the universe is laying out such blatant clues, that one would need to be in a coma not to see what is unfolding.

So conspicuous, in fact, that calling them clues would be a misnomer. At this point, we may as well just call them what they really are: evolution.

So, without any further ado, here’s my 2021 recap as well as my 2022 predictions, henceforth known as certitudes.

The 2021 Recap:

When it comes to the conventional markets, last year I predicted that the hospitality industry, particularly restaurants, would stage a comeback and that traditional media would wane. In fact, I called established media and entertainment the biggest short since, well, the “The Big Short”.

Low and behold, publicly-traded hospitality and restaurant stocks had a banner 2021. And broadcast media, well not so much.

In 2021, Darden Restaurants (NYSE: DRI), owner and operator of 1,834 restaurants including The Olive Garden, The Capital Grille and Seasons 52, experienced a 21.5% increase in its stock price – surpassing even its pre-pandemic all-time high by 29% and soaring 176.6% from its pandemic low. Even fast food operator, YUM! Brands (NYSE: YUM) was up 31.5% in 2021, increasing 139% from its 2020 low.

ONE Group Hospitality (NASDAQ: STKS), a business that develops, owns, operates, manages, and licenses restaurants and lounges worldwide, saw its stock appreciate over 240% in 2021 as Hilton Worldwide Holdings Inc. (NYSE: HLT) increased 38%.

Unfortunately, the smaller mom-and-pops have not fared nearly as well as their publicly-traded counterparts. According to the National Restaurant Association, more than 110,000 eating and drinking establishments in the United States had closed for business—temporarily or permanently – due to Covid. Sadly, many of these restaurant closures could have been avoided, altogether, had there not been a government-engendered personnel shortage. In fact, in 2021, a record 75% percent of restaurant operators reported that recruiting employees is their top challenge.

While the publicly-traded hospitality conglomerates clearly carried the industry’s growth in 2021, there is hope in store for America’s small business owners. With innovative companies like Securitize, which are leveraging blockchain technology to democratize the corporate finance landscape and enhance the ability for smaller businesses to attract consumers, mom-and-pop hospitality providers will have a more level playing field to compete with the larger players for both investment capital as well as patrons.

While incentivizing workers and implementing fintech protocols can resolve many of the hospitality industry’s challenges, nothing – and I mean, nothing – is going to salvage traditional media and entertainment business models. Conventional media is nearing the end of its Cretaceous period where it will be forced to either mate with innovation or become a fossil.

As I said last year, “media is at a very interesting crossroads. Traditional media is dying of old age while social media is killing itself with censorship. All areas of media could use some decentralization, democratization and truth. Indeed, it could use some blockchain.”

2021 was a tough year for corporate media which, for the most part, has bled viewers. While FOX may have performed adequately, with its shares up 13%, Discovery, ViacomCBS and Disney all experienced double digit loses in 2021, down 32%, 25% and 13% respectively. Even Twitter underwhelmed – ending the year down 17% and struggling to grow its US userbase.

But, there was one conventional entertainment company that stood out: AMC Entertainment Holdings Inc. (NYSE: AMC), the theater chain. AMC appreciated 1,227% in 2021. And, it did so, not simply by becoming a meme, but by embracing fintech to increase revenue, enhance its marketing results and strengthen its customer relations. In addition to now accepting cryptocurrencies as payment, AMC also adopted some rewards-based crowdfunding methodologies by implementing innovative programs to gift shareholders with product-related perks. In doing so, AMC has been able to transform from a relic into a trailblazer. Expect many more entertainment conventionalists to follow suit in 2022.

Speaking of cryptocurrencies, last year I predicted that bitcoin, would surpass the trillion-dollar mark. It did. I also predicted that, by the end of 2021- and with help from DeFi (Decentralized Finance) – the cryptocurrency marketplace would be worth over $2 trillion, but with bitcoin’s market share beginning to wane. Well, last year at this time, bitcoin comprised approximately 70% of the nearly $800 billion cryptocurrency marketplace. Today, bitcoin encompasses just 39.7% of the $2.3 trillion cryptocurrency marketplace.

I also predicted that, in 2021, Ethereum (ETH), which was hovering around the $700 last year, would surpass $3,500, and that Chainlink (LINK), which was fetching around $11, would surpass $42. Well, in 2021, both exceeded my expectations with ETH reaching $4,812 and LINK reaching $51.96. Although both ended the year off of their highs, I remain bullish.

I also forecasted that DeFi would continue to expand in 2021. Lo and behold, DeFi had another banner year, increasing another 549% on top of its impressive 2,000+% 2020 growth, and now surpassing a $128 billion market according to DappRadar.

While all of these prognostications proved to be right on-the-money, by far, my finest prediction was that DeFi would inspire significant financial innovation in 2021.

Last year I stated, “DeFi is helping to facilitate the development of a modern finance method known as Asset Tokenization which has the potential to bring trillions of dollars of real-world value on to the blockchain and inspire the most prolific era of asset innovation in the history of mankind.”

Asset Tokenization is essentially the process of converting all kinds of tangible and intangible assets (such as private company stock, real estate, art, wine, cars, sports contracts, college degrees, you name it) into digital assets on a blockchain. Tokenized assets are essentially NFTs (non-fungible tokens). And in case you have been living under a rock or hiding from new covid variants, NFTs have exploded in popularity in 2021, rocketing to a $24 billion market, according to DappRadar.

And this is just the beginning. Marketplaces for NFTs are poised to soar.

OpenSea, the most popular marketplace for non-fungible tokens, which was valued at $1.5 billion just 5 months ago is already fielding investment offers that could increase its valuation to $10 billion – another huge win for Andreessen Horowitz’s venture capital firm a16z. Too bad, the same can’t be said for OpenSea’s 1.4+ million NFT traders who made its impressive growth possible. Fortunately, asset tokenization (NFTs) will soon play a role even in remedying the egregious disparity in venture investing.

To learn more about NFTs, check out Session 7 of Sarson Funds’ groundbreaking Level 1 Crypto Advisor Certification Course which provides an invaluable (and complimentary) introduction to non-fungible tokens.

The 2022 predictions certitudes:

1. FINTECH EXPANDS BEYOND BANKING AND FINANCE

I believe that 2022 will be the year that fintech begins sowing the seeds of a colossal cultural expansion that will extend well beyond banking and finance. Media, government, healthcare and education are all on deck to be most impacted – indeed transformed – by this fintech incursion.

Media: Traditional media advertising revenue models will be upended when consumers are readily able to leverage blockchain innovation such as NFTs and cryptocurrencies to monetize their own eyeballs. Individuals will soon be directly profiting from the programs they watch, the shows they create, and the celebrities they revere. Most significantly, individuals will be reclaiming the rights to the most valuable asset known to man: one’s personal data.

Healthcare: Fintech style savings apps will be used to make Health Savings Accounts (HSAs) more practicable while DeFi protocols will help ensure the decentralization of the health insurance industry at large. Instead of a single entity controlling the consent and funding of treatments, via smart contracts and blockchain oracles such as Chainlink, health insurance will become community-centric and “crowd” funded. As a result, the physical as well as the financial health of Americans will begin to improve. Speaking of health, bid farewell to covid, for it will be eradicated once and for all in 2022.

Education: Much like media, fintech will revolutionize education by enabling students to monetize their curriculum participation. In fact, I am so confidant that modern fintech-inspired incentivized learning models will play a significant role in narrowing wealth gaps and thwarting a looming retirement-induced economic crisis that I am devoting the rest of my career to it.

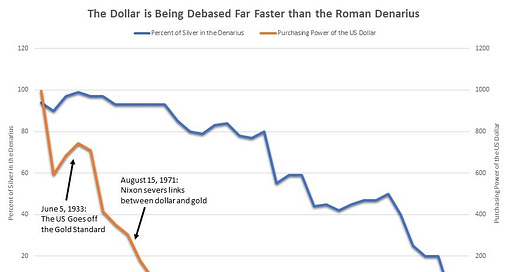

Government: If you think that nothing could rein in unrestrained government spending, you would be wrong. It will be fintech that ultimately controls the power-switch to those hazardous government money printing presses. I predict that at some point in time (though definitely not in 2022), bitcoin becomes the modern-day gold standard where the value of all national currencies will be based on their bitcoin reserves. It will be the “bitcoin standard” that ultimately prevents governments from printing their way to annihilation in famous ancient Rome fashion.

Although it is fintech that holds the promise to democratize global wealth by making healthcare more affordable, learning more lucrative, media more financially just and governments less corrupt, there will be those who will fight tooth and nail to maintain the status quo.

2. AT ITS OWN PERIL, GOVERNMENT WILL DECLARE WAR ON FINTECH INNOVATIONS SUCH AS DEFI AND NFTs

I predict that under the guise of “protection”, a concerted war will be waged against fintech innovation – particularly DeFi protocols and NFTs. Expect both to be attacked by regulatory bullets and propaganda machines warning citizens of the “perils” of decentralized finance and asset tokenization. Without informing the public as to why, prepare for the “we deem DeFi products and NFTs to be securities” mantra emanating from the SEC. Fortunately, no matter how much the powers-that-be attempt to thwart the very innovation that fosters financial democracy, their efforts will ultimately fail. In the end, rightness will prevail and progress will ensue. In fact, the only thing that these misleading smear campaigns will accomplish is the creation of dip-buying opportunities. Those who missed out on the 2021 run will be especially grateful.

3. DEFI AND NFTs WILL PROVIDE PROTECTION FROM AN ECONOMIC TSUNAMI

The growth of the DeFi and NFT markets will foster unprecedented diversification opportunities. This is especially crucial considering that the institutional adoption of cryptocurrencies has led to the increased correlation of asset classes and the diminishing of safe-havens. I’ve been predicting, for some time now, that asset tokenization would be the solution to institutional-induced increased asset correlation. I not only stand by this prediction, I am doubling-down on it. The endlessly proliferating universe of micro investment options, cultivated by DeFi and NFTs, will provide the negative correlations and portfolio diversification needed to weather the economic tsunami brought on by uncontrollable inflation and irresponsible monetary and fiscal policies.

4. BLOCKCHAIN PROTOCOLS THAT SUPPORT DEFI AND NFTs WILL THRIVE

Blockchain protocols that run DeFI applications and support NFTs will continue to thrive. While Ethereum has a strong first-mover advantage in this area (presently representing 71% of NFT marketplace and 83% of the DeFi, according to DappRadar), other blockchains that currently offer faster transaction speeds and lower gas fees have begun giving Ethereum a run for its money. Solana and Tezos are two blockchain protocols, in the space, that have been growing in prominence. Solana experienced exponential growth in 2021, ending the year up over 9,000%. Although Tezos outperformed in 2021 (up 130%), I believe that 2022 will be its strongest year yet. I had the privilege of moderating a panel with some of the world’s foremost developers on the Tezos blockchain at Draper, Goren, Holms’ Global DeFi Summit this past summer. And, according to the boots on the ground, there is a lot of movement to Tezos as well institutional interest.

5. THE CRYPTOCURRENCY MARKET WILL REACH NEW ALL-TIME HIGHS

The cryptocurrency market will, once again, reach new all-time highs in 2022 – especially as more investors will come to view digital assets as a necessary and viable inflation hedge.

6. MODERN ROME WILL FALTER BUT THE TWENTY-TWENTIES CAN STILL ROAR

I still believe that the 2020s have the potential to roar and that fintech – particularly blockchain innovation – will ultimately be what saves America from a looming financial collapse that would put Rome to shame. But, as an optimist at heart, it upsets me to predict that things will get worse before they get better – particularly in another big election year and following a period of epic spending and printing. Case in point, 25% of all US dollars currently in circulation were printed in the past year alone. The US is debasing its currency at an unprecedented rate – far faster than even ancient Rome.

Interest rates will rise to combat rampant inflation, and the inevitable rate hike will cause the broader markets to correct. Although it will be painful for many, the ache will not be permanent and those in digital assets will best endure.

Like temporary side-effects caused by the only medicine capable of curing a disease, modern Rome will falter so that the twenty-twenties can roar. As dismal as it will seem, remember, it is always darkest before the dawn. Fortunately, unlike the ancient Romans, we have a savior. It’s called blockchain innovation. And to conclude another annual predictions article with the lyrics and imagery of a U2 song, blockchain’s “gonna kick the darkness ’til it bleeds daylight.”

That I can promise.

Wishing everyone the happiest of HODLdays and a healthy and prosperous 2022!