Next-Gen Blockchain Use Cases for Combating Inflation

Remember all the big talk about inflation being under control - not to mention all of that 2024 rate cut signaling which gave the stock market a nice end-of-the-year bump?

Well, evidently, it was all just empty rhetoric.

Recent indicators - on both sides of the Atlantic - denote that inflation is far more problematic than had been anticipated.

Previous blather of “soft landings” is quickly being replaced with fears of stagflation, an economic quandary that the Decent Millionaire has been warning about for two years. See: https://decentmillionaire.substack.com/p/decentralization-will-shape-the-future

While words may move markets, it is data that transforms them.

What today’s data clearly affirms is that the conventional methods of tackling inflation have utterly failed us.

As it stands, Americans have already lost over 25% of their purchasing power in the past few years. And, the situation is not much better overseas. In the UK, the British pound has lost around 30% of its value during the same timeframe.

Until a viable solution is introduced, higher costs of living will continue to plague every single consumer, business and investor.

Some maintain high hopes that bitcoin - with its fixed supply of 21 million coins shielding it from the catastrophic consequences of endless central bank money printing - will emerge as the great inflation conqueror.

Although transitioning to the “bitcoin standard” may very well be what ultimately defeats man-made inflation, the fact is that right now bitcoin, as a sole portfolio diversifier, is simply not enough to protect today’s investment portfolios from inflation-caused market downturns.

This is because, thanks to growing institutional adoption, bitcoin no longer holds the allure of being a non-correlated asset class.

Even though institutional buying helps elevate the price of bitcoin, the tradeoff is an increase in correlation to other asset classes, thereby diminishing bitcoin’s efficiency as a formidable inflationary hedge. See: https://decentmillionaire.substack.com/p/get-ready-to-protect-your-investment

The reason is simple. Institutional investors employ similar investing playbooks, follow homogeneous trading algorithms and rely on the same unreliable government data. Hence, when stock markets are tanking, institutional investors tend to adjust their portfolio holdings in unison. In many cases, they liquidate their better performing assets like bitcoin - not due to weakening fundamentals - but rather in order to cover shortfalls in their declining equity positions. As a result of institutional homogeneity, even the most negatively correlated assets can quickly become positive.

Fortunately, even as bitcoin loses some of its inverse correlation appeal, more efficacious blockchain use cases are emerging to protect individuals from uncontrollable inflation.

Whether it is being used to tokenize inflation-resistant collectibles such as rare wine; introduce more accurate inflation metrics; or even to engineer novel inflation-proof stablecoins, this next-generation of blockchain ingenuity is proving to be powerful weaponry in civilization’s war against inflation.

Readers who are interested in learning more, as well as earning financial rewards, are welcome to join our upcoming complimentary Learn2Earn webinar where blockchain leaders from dVIN and Truflation will introduce some of the most exciting new blockchain use cases that are being employed to combat inflation and shield individual wealth from purchasing power erosion.

Related Decent Millionaire Posts

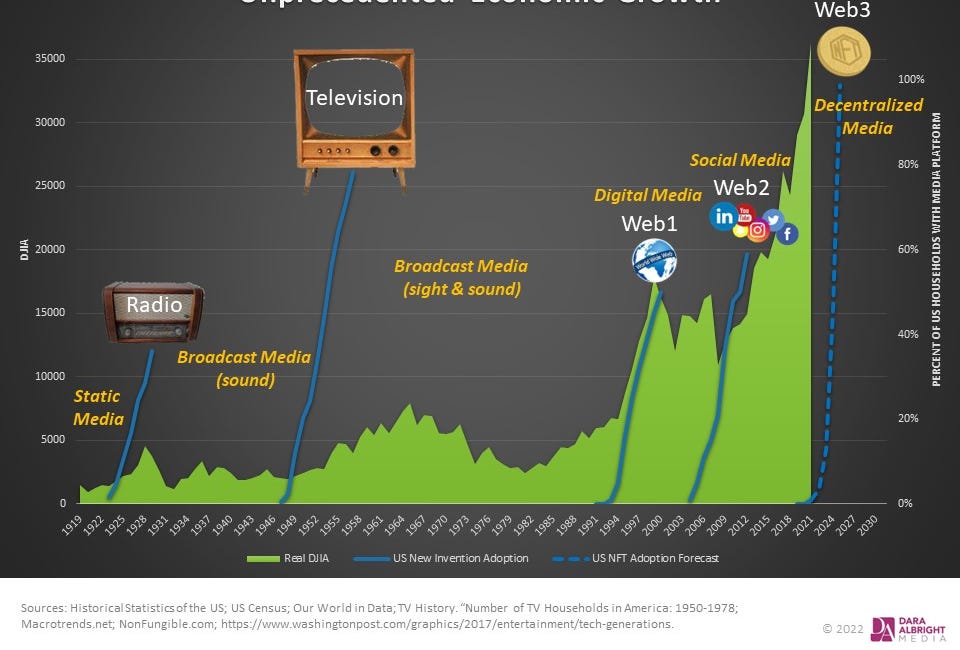

Decentralization will Shape the Future of Humanity

For years I have been publishing articles summarizing the closing year and forecasting the years to come. Most, but not all, of my predictions have come to fruition leading me to believe that I inherited a slightly flawed clairvoyant gene. As I review last year’s

Get Ready to Protect Your Investment Portfolios with Tokenized Collectibles

There are presently about 4,200 U.S. listed companies - about half as many as there were in 1996 when it was far more affordable and less regulatorily cumbersome to be a publicly-traded company. There are also approximately 500,000 unique corporate bonds in the U.S. - most are byproducts of those 4,200 remaining listed companies.

Blockchain and Fintech Innovation will Save America from Purchasing Power Erosion

Those who have read my 2024 predictions post know that I’m on the Paul Krugman exercise regimen where I do 100 sit-ups, 50 jumping jacks and 5 minutes of planking every time Paul Krugman publishes an article lauding the U.S. economy. Thanks to Mr. Krugman, I expect to have washboard abs by the time the summer arrives.