Who is Playing Games with Whom, Mr. Gensler?

Ever since Gary Gensler took over the reins of the U.S. Securities and Exchange Commission on April 17, 2021, he has been hard at work trying to claim jurisdictional ownership of the cryptocurrency market.

It would appear that Mr. Gensler has been so preoccupied with his quest for regulatory control that he has been completely neglecting his primary duties which include ensuring fair, orderly, and efficient markets; facilitating capital formation; protecting investors and building public trust in the markets.

Under his watch, Gensler allowed a videogamer to steal billions of dollars from the very investors he was hired to protect. While that is bad enough, overlooking a multi-billion dollar fraud is just the very tip of the iceberg.

In what can easily be viewed as one of the craftiest wealth confiscation schemes since the advent of income tax, through the FTX theft, Gensler enabled nearly $100 million of we-the-people’s money to be transferred right into the coffers of salivating politicians.

And, the dereliction of duties doesn’t stop there.

Since Gensler’s kingship began, the SEC managed to help wipe out over $1 trillion in investor cryptocurrency wealth as well as export much of our most promising innovation overseas.

All this in less than two years.

Instead of policing the legitimate fraudsters, Gensler has been laser focused on suing our nation’s brightest and most capable entrepreneurs and innovators. You know, the ones who can actually save America from an economic free-fall.

Cryptocurrency-related enforcement actions increased 50% in 2022, with the majority of the SEC cryptocurrency enforcement allegations stemming from the offering or sale of what Gensler believes to be unregistered securities - not for something as heinous as, oh I don’t know, using stolen investor money to enrich politicians!

Even more abhorrent, many of the SEC’s recent enforcement actions are against individuals directly. For those who never experienced the pleasure of litigation, suing individuals directly is a legal tactic designed to inflict maximum psychological and financial pain.

When Gensler isn’t aiding in the destruction or confiscation of wealth, he is spending time on the media circuit accusing the cryptocurrency industry of “playing a game with his agency”. According to Gensler, cryptocurrency companies “are well aware of what they have to do to operate legally within the U.S. but they’ve decided not to do it.”

Does Gensler have a point? Are cryptocurrency projects intentionally trying to evade U.S. security laws?

Let’s put aside the neverending “is-cryptocurrency-a-security-or-is-not” debate for a moment and entertain Gensler’s presumption that cryptocurrencies are, after all, securities. Are cryptocurrency entrepreneurs realistically able to work within the existing U.S. regulatory securities framework if they so choose?

The answer is a resounding, NO - at least not under the Gensler regime where cryptocurrency-related endeavors are blatantly failing to receive SEC approval.

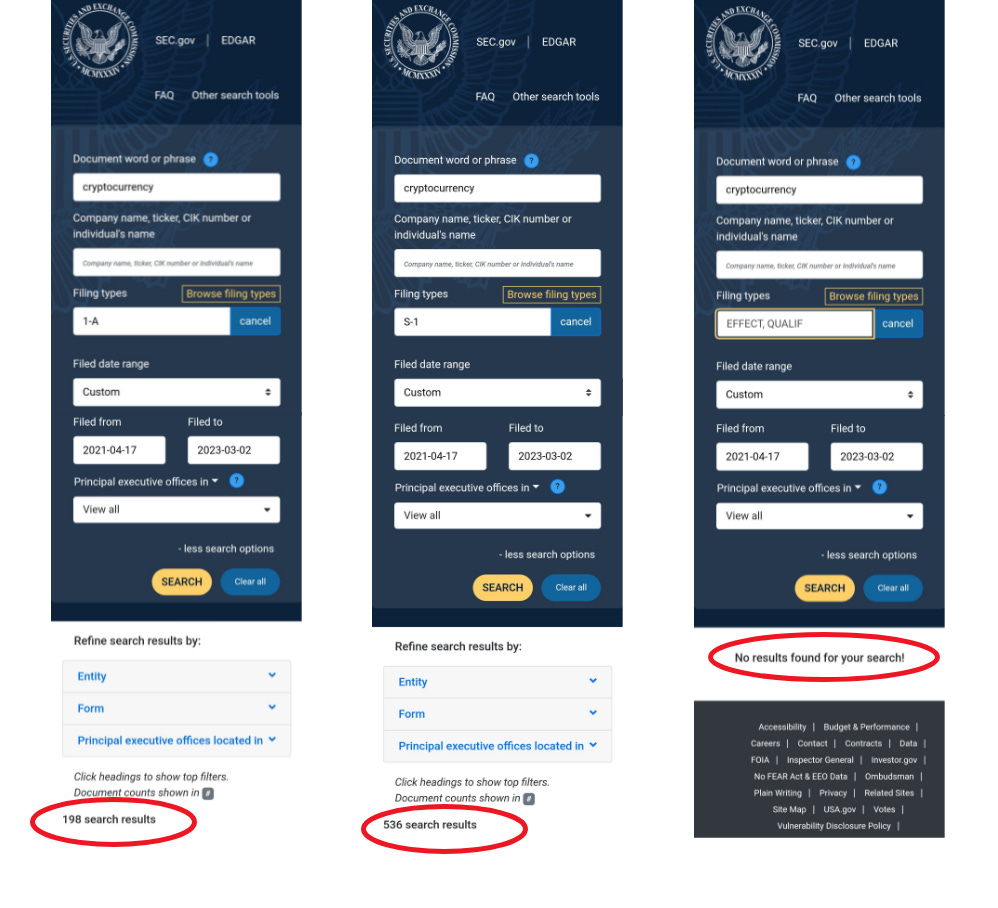

A quick search on EDGAR shows that, since the day that Gensler took over as Chairman of the SEC, there have been 536 S-1’s and 198 Form 1-A’s filed with the term, “cryptocurrency” in its application. Of those 734 submissions, ZERO have been qualified.

ZERO.

This begs the question, who is playing games with whom, Mr. Gensler?

Check out part II of this article: 4 Reasons Why the SEC will Cease to Exist.