I have an important message for retail investors.

The U.S. capital markets are failing you.

And it is not because of tariffs, fiscal policy or wars waging on foreign soils.

They are failing you because of a defective, undemocratized, homogeneous stock market structure that benefits a few select businesses and investors at the expense of everyone else.

They are failing you because of an unconstitutional accredited investor rule that prohibits 90% of you from having access to the same asset appreciation and portfolio diversification as the wealthiest ten percent.

They are failing you because the Self-Regulatory Organization that is tasked with educating investment advisors is neglecting to properly train them on alternative asset portfolio diversifiers.

And the capital markets will continue to fail you unless the stock exchanges, once again, become viable breeding grounds for successful small cap IPOs, and until all alternative investment products are available to all.

The good news is that many regulatory obstacles that prevent equal access to portfolio diversification are finally being eliminated through rule amendments and legislative changes.

The better news is that innovation is ensuring that superior alternative asset portfolio diversifiers are affordable and easily accessible to all.

And the best news is that no one has to wait to start generating better risk-adjusted returns.

A growing number of SEC-qualified alternative investment products are already available - even to small retail investors. And a handful of publicly listed stocks, operating outside the sphere of influence of the market’s three main orchestrators, offer a compelling way to lower portfolio correlation and reclaim true diversification.

Highlighted below are a number of portfolio diversifiers can help provide all investors with protection from a monopolistic and rapidly shrinking stock market that is failing everyday American investors.

TODAY’S RETAIL PORTFOLIOS ARE NOT AS DIVERSIFIED AS WE ARE LED TO BELIEVE

Before I dive into some of these portfolio diversifiers, it’s critical for both investors and financial advisors to confront an uncomfortable truth: most retail portfolios today are far less diversified than they appear.

Regardless of how assets are allocated across stocks, bonds, mutual funds, or ETFs, a portfolio built solely on these traditional assets is often dangerously exposed -especially during periods of market volatility.

These portfolios offer no protection from systematic risk (market-wide risk), which cannot be diversified away. And due to the ongoing decline in the number of U.S. listed companies, even idiosyncratic risk (company-specific risk) - once easily mitigated through broader stock selection - has, too, become undiversifiable without an increased allocation to alternative assets.

Let me explain with a few eye-opening charts.

Publicly-traded stocks, bonds, mutual funds and most ETFs are all byproducts of a diminishing pool of listed companies.

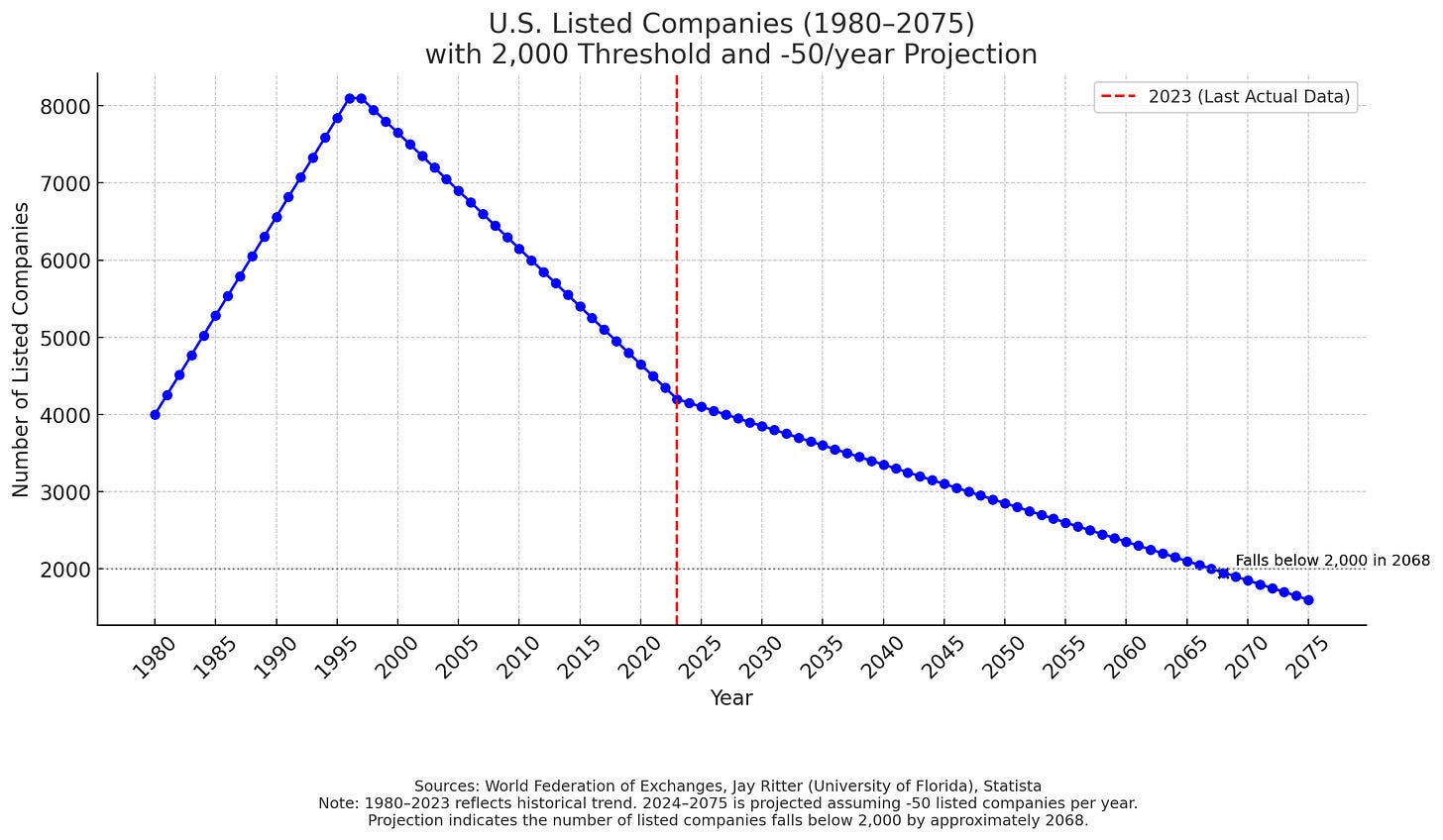

There are presently about 4,300 U.S. listed companies in total - down from approximately 8,000 in 1996, and on a trajectory to be well under 2,000 within the next 50 years.

Even more concerning is that as the number of listed companies continues to decline, the average market capitalization of those remaining keeps surging - eroding market diversity, amplifying systemic risk, undermining economic resilience, and concentrating power in the hands of a small clique of mega-corporations.

And that is only part of the story.

Equity ownership is increasingly concentrated in a much smaller subset of actively traded stocks. Of the roughly 4,300 listed U.S. companies, only about 250 see daily trading volumes exceeding 5 million shares.

Active portfolio managers engage with only a sliver of the market - just 0.7% to 2.8% of listed stocks, on average. Most actively managed mutual funds only hold between 100 and 120 stocks, while small-cap or sector-specific funds often narrow that exposure to just 30 to 70 names.

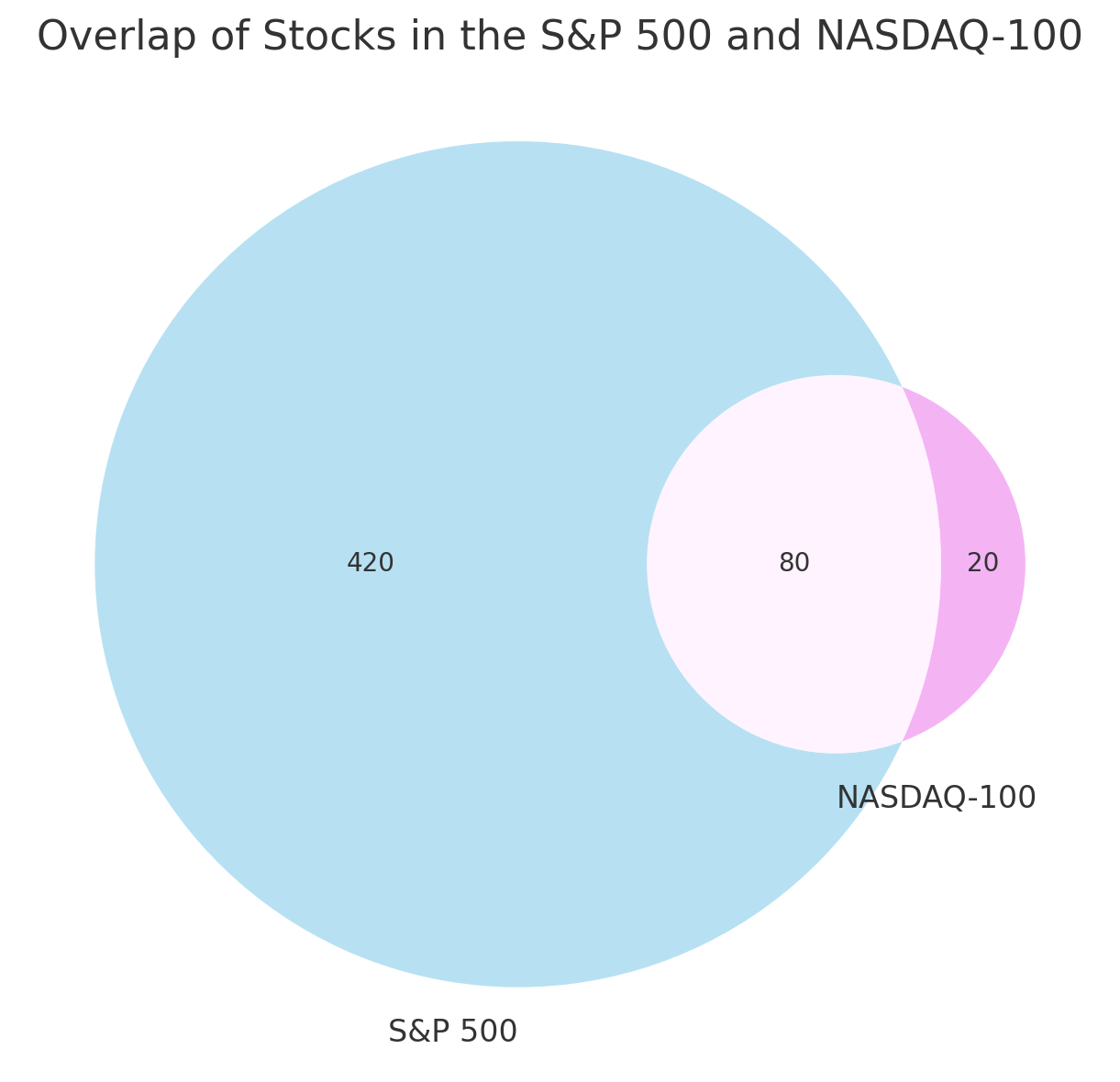

The concentration is even more extreme within passive funds that closely mirror major indexes. Just 10 stocks now make up about 35% of the S&P 500’s weight. Even more astonishing is that 7 of those 10 stocks account for nearly 50% of the NASDAQ-100.

This isn't a pool - this is a goldfish bowl. And with a near-perfect positive correlation between these two indices, investors in both are essentially buying the same concentrated exposure, dressed up as diversification.

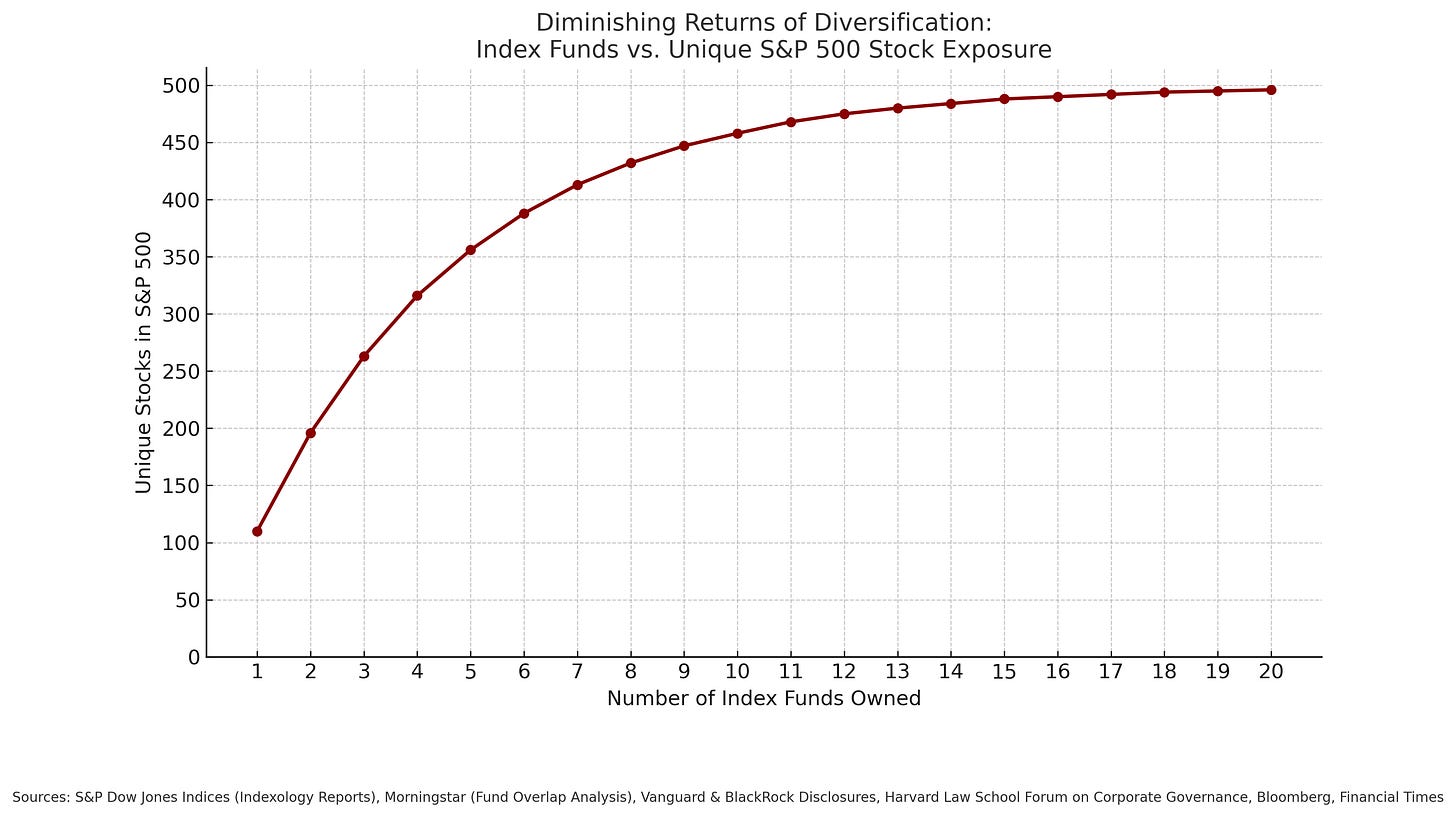

And it is not just NASDAQ and the S&P 500 that have grown in correlation. As the chart below illustrates, there are diminishing diversification benefits of holding multiple index funds due to overlapping S&P 500 constituents.

As the top 10 stocks grow in dominance, the U.S. equity markets will only become more fragile, more volatile, and even more dependent on the performance of the corporate elite. For everyday investors, that means that the lack of diversification will only intensify, and the market swings will be bigger than ever.

Furthermore, fixed-income investors won’t find diversification among publicly-traded corporate bonds either. Out of the approximately 4,300 listed companies, maybe 1,000–1,200 have issued bonds at all. Of those, only about 300–400 companies have bonds that are actively traded daily. Even inside that group, the top 50 issuers dominate the bond liquidity.

To put things into perspective: nearly $29.1 trillion in mutual funds, $10.4 trillion in ETFs, and an additional $8–10 trillion in direct retail capital - 93% of which comes from the wealthiest 10% of Americans - are all largely chasing the same 10 stocks and 50 bonds.

What was once the hallmark of American capitalism - broad access, open competition, and dynamic markets - has been hijacked by a concentrated few who suppress innovation, strangle competition, and capture the lion’s share of the gains.

At the center of it all are just three firms - BlackRock, Vanguard, and State Street - which collectively manage an estimated $22 trillion in U.S. equity assets. If current trends continue, their combined U.S. equity holdings would surpass $30 trillion by 2040, giving them control of more than half of the entire U.S. stock market’s capitalization. This is not capitalism. This is a financial oligarchy wrapped in the veneer of free markets.

As it is, the Big Three are the largest shareholders in 40% of all publicly listed U.S. companies and 88% of S&P 500 firms. This already gives them extraordinary influence over corporate governance and market direction.

Furthermore, because they employ complex hedging strategies, the Big Three are positioned to profit regardless of whether markets rise or fall.

When the Big Three are content, the market follows. Take the COVID-19 crisis, for example: as their largest equity holdings were deemed “too essential to close,” the Big Three poured capital into those positions - driving stock prices higher while countless small businesses, selling the exact same “essential” products, were forced to shut their doors. The result? An unequal recovery - not powered by competition, but orchestrated by an oligopoly.

And when they’re displeased - say, by the threat of tariffs cutting into the profit margins of mega-corporations built on overseas sweatshop labor - they don’t hesitate to retaliate. They dump or short positions, triggering massive sell-offs that ripple through today’s hyper-correlated indexes - taking down the retirement portfolios of everyday Americans in the process.

As the markets rebounded, the April sell-off proved to be a buying opportunity for deep-pocketed giants like the Big Three, who scooped up stocks at discount prices. Meanwhile, most Americans - especially those nearing retirement - were left with sinking portfolios and rising anxiety.

This isn’t just a market distortion - it’s a structural threat. When a handful of firms can move entire markets, profit on both sides of volatility, and dictate which companies survive or collapse, the very foundation of capitalism is compromised.

BEATING THE OLIGARCHS

Interestingly, the recent market correction didn’t impact all assets equally. Equities backed by passionate consumers-turned-investors (“investumers”), along with decentralized assets like Bitcoin, showed notable resilience - outperforming both the S&P 500 and NASDAQ. It underscores a critical truth: true diversification - away from institutional dominance - may be one of the last remaining safe havens when systemic shocks hit.

Fortunately, the rise of asset tokenization and a potential wave of investumer IPOs offer a path forward - one that would dramatically expand the universe of investable assets, genuinely democratizing access to U.S. capital markets and narrowing the wealth gap in the process.

As the above chart illustrates, the number of publicly listed U.S. companies per million people has steadily declined since its 1996 peak - while wealth inequality has soared. If America is to remain the free nation, as envisioned by our founding fathers, this trajectory must change.

Fortunately, as indicated by the dotted lines, a better future is within reach. Through investumer-led IPOs and the tokenization or fractionalization of traditionally inaccessible assets - real estate, rare wine, art and so much more - we have the tools to dramatically expand the universe of investable assets. This concurrent transformation could not only reverse the decline in market access, but also catalyze a historic reduction in wealth inequality, breaking the cycle of consolidation and exclusion that has defined the past three decades.

While the tokenization and investumer revolutions are still unfolding, investors don’t have to wait to benefit. The following portfolio diversifiers already offer the potential for stronger risk-adjusted returns - even for small retail investors - marking a hopeful shift toward a more inclusive and resilient financial future.

Retail Private Credit: As traditional lenders pull back and interest rates remain elevated, private credit markets have exploded - offering direct lending opportunities that bypass Wall Street intermediaries. Once the domain of hedge funds and institutional investors, private credit is now increasingly accessible to small retail investors through tokenized platforms and fractionalized debt offerings. Modern financial providers, like Worthy Wealth, offer everyday investors an opportunity to receive up to 15% in annualized returns via an innovative SEC-qualified bond product. As an added benefit, Worthy users can also effortlessly accumulate higher yielding fixed-income products through Worthy’s digital round-up savings app.

Pre-IPOs: I recently published an article on how Newsmax (NMAX) - an OTT (Over-the-Top) media platform - set a new precedent for modern IPOs and “investumer” stocks. In a market where hot offerings are usually reserved for venture capitalists, private equity, and the ultra-wealthy, the Newsmax IPO broke the mold. With a minimum investment of just $500, Newsmax gave everyday investors - its own loyal customers - early access to a high-growth opportunity before its record-setting two-day surge, all amid broader market volatility. But this was more than just an IPO - it was proof of concept. It showed that a mobilized consumer base can become a powerful investor community, potentially paving the way for a new era of small-cap IPOs fueled by brand loyalty and retail conviction. That said, caution is still warranted. Most Reg A+ IPOs don’t follow this playbook. The key is to look for offerings with truly engaged audiences and experienced underwriters who can anchor valuations in reality - not hype.

👉 See: How a Next-Generation Media Company Revived the Small IPO and Galvanized a New Breed of Enthusiastic Investors and Capital Ideas Podcast Episode 26: Inside the Newsmax IPO and How Reg A + Can Democratize Wall Street.

Publicly-Traded Investumer Stocks: In addition to Newsmax, there are also two other already publicly-trading investumer stocks that I like for their impassioned retail investor-bases: Trump Media & Technology Group Corp. (DJT) and GameStop (GME). While it’s true that Vanguard, BlackRock, and State Street have recently accumulated positions in DJT and GME through their index-tracking strategies, the strength of the retail conviction in these names enabled them to outperform the broader markets during the recent volatility - proving that investumer stocks can provide meaningful protection from some of the Big Three’s market shenanigans.

Stocks that Provide Indirect Bitcoin Exposure: Beyond its vast and passionate “investumer” base, GameStop (GME) holds something else of growing strategic value: Bitcoin on its balance sheet. Increasingly, companies are diversifying their treasuries by replacing fiat or low-yield assets like Treasury bills with deflationary assets such as Bitcoin - a move viewed by many as both savvy and forward-thinking. For businesses, Bitcoin serves not only as a store of value but also as a hedge against the risks embedded in their own operating models. For investors, it offers a simple, indirect way to protect against inflation and currency debasement - while gaining Bitcoin exposure through public equities. Several publicly traded companies now hold Bitcoin in their treasuries, including Tesla (TSLA), MicroStrategy (MSTR), Marathon Digital (MARA), and the newly listed, Draper Associates–backed Fold (FLD) - the first publicly traded Bitcoin financial services firm helping individuals and businesses earn, save, and spend Bitcoin.

Holding Crypto Directly: I’m also a strong advocate for holding cryptocurrencies directly - especially Bitcoin. Even a modest allocation has consistently outperformed the now-obsolete 60/40 portfolio. In an era of monetary debasement and institutional distortion, Bitcoin isn’t just a portfolio diversifier—it’s a portfolio essential.

Best of all, many digital and alternative assets can now be held in tax-advantaged retirement accounts. If you’re curious about innovative strategies for integrating alternatives - like private equity, private credit, or even multiple cryptocurrencies -into your retirement plan, feel free to reach out.

I also welcome collaboration with innovators building platforms that expand retail access to alternative investments.

It’s been more than 30 years since diversification was made a mandate for fiduciaries under the Prudent Investor Rule. So why is it still a privilege for everyday Americans?

Let’s restore freedom, fairness, and broad participation in our markets.

The time is long overdue.

👉 Have thoughts on this post? Ideas? Drop a comment or send me a message. I read every one.

📬 Want more insights like this? Subscribe to stay ahead of the curve.

The information provided in this article is for educational and informational purposes only and should not be construed as investment advice, or as an offer or solicitation to buy or sell any securities. The strategies and themes discussed may not be suitable for all investors and should be evaluated in the context of each individual’s investment objectives and financial circumstances. Past performance is not indicative of future results. The author may hold positions in, or have financial interests related to, the companies mentioned. All opinions expressed are solely those of the author and are subject to change without notice.