U.S. banks are collapsing.

This is exactly what happens when financial institutions - in cahoots with the government - make bad bets using over-leveraged OPMs (Other People’s Monies).

Ignoring the glaring warning signs of imminent inflation, banks used our deposit money to buy inflationary-prone Treasuries, during one of the fastest rate hikes in history.

Well, with foreign investors’ interest in U.S. debt waning, I guess someone had to buy those not-so-safe-after-all Treasuries. Economic lockdowns, endless wars and entitlement programs don’t pay for themselves, you know. Someone needs to foot the bill, and our taxes don’t come anywhere close to covering it.

As it is, the federal government already receives around 32%, or $4.9 trillion, of America’s real disposable income in the form of tax revenue. Even if the U.S. decided to tax 100% of the $15.35 trillion of real disposable personal income for the next 6 years, it would still be one trillion dollars short of its $93.1 trillion in unfunded social security and medicare liabilities, alone.

But I digress.

The fact is, banks do not deserve all of the blame for overlooking inflation harbingers.

Afterall, the Federal Reserve has a sordid history of manipulating CPI calculation methods and concealing money supply data - even though it insists that increases in money supply doesn’t cause inflation or currency debasement.

Ummmm, okay. If there is no repercussion to increasing the money supply, then why all the great lengths to suppress the information?

Two years before the financial meltdown of 2008, the Federal Reserve tried to hide the excessive growth in the money supply by ceasing publication of the M3 monetary aggregate, professing that M3 “did not appear to convey any additional information about economic activity that is not already embodied in M2.”

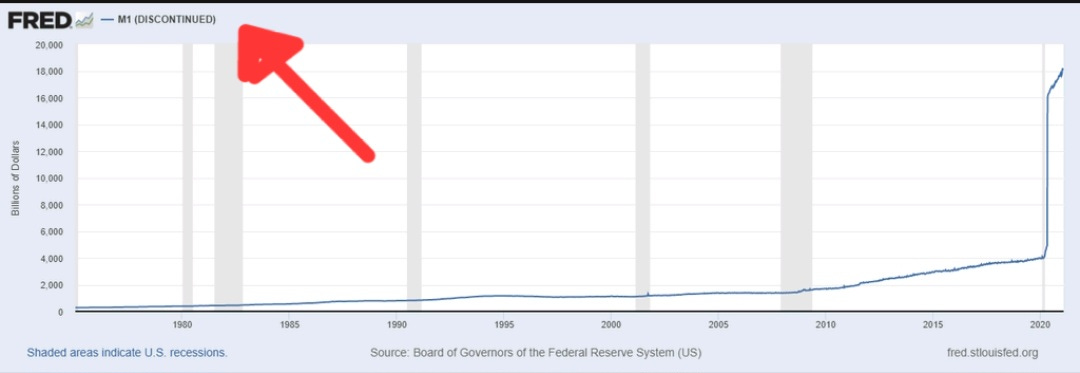

But, as the chart below clearly depicts, in reality, M3 had been escalating at a much more alarming rate than M2. The Fed can’t have any squealers, so like any mob snitch, the M3 was “disappeared” out of existence.

Not long after, it looked like another inflation gauge was about to rat. So, in early 2021, the Federal Reserve discontinued publishing the weekly money supply data, and government henchpeople were sent on media tours to deny any hints of inflation.

They used outdated CPI data from the Bureau of Labor Statistics (BLS) - the government agency notorious for its crafty inflation data readjustments - in attempt to substantiate their “zero inflation” narrative.

But, despite the Fed’s great efforts to conceal it, inflation began making headlines in April 2021 with the CPI increasing at a pace not seen since 2008. Instead of taking swift action to fix it, Treasury Secretary Janet Yellin went on another media campaign insisting that the inflation was “transitory” and nothing to worry about.

I know this may come as a surprise to some, but, as it turns out, pretending that a problem doesn’t exist doesn’t make it go away.

After a year of doing nothing to quell the inflation, the PR spigots needed to be turned on again. Their next story was that the raging “temporary” inflation we’ve been experiencing since early 2021 was due to Putin’s invasion of Ukraine - which didn’t occur until 2022.

When the populace could no longer be persuaded into believing that inflation had nothing to do with an invasion that had not yet happened, or be convinced that the 40% more they were paying at the gas pumps and the 50% more they were paying for eggs were figments of their imagination, the Fed had no choice but to finally address the problem and start hiking interest rates.

Rates have gone from nearly zero in March 2022 to a range of 4.75% to 5% today - a 6,000%+ increase in just one year’s time. And the Fed still doesn’t think it is enough.

In addition to relying on outdated and inaccurate data, the Fed’s procrastinations and denials have proven cataclysmic - demolishing the banking system and costing jobs. Federal Reserve Chair Jerome Powell predicts that at least 2 million people will lose their jobs from his rate hikes.

And the worst part is that much - if not all - of this economic damage could have been avoided simply by being honest and confronting the problem when it first surfaced.

Is it any wonder why people are losing faith in the conventional financial system and, instead, turning to fintech and decentralized assets?

According to blockchain-based real-time, daily inflation tracker, Truflation, U.S. inflation now stands at less than 4% - more than two points lower than the most recent BLS report which was released last month. Yet, the Fed is still raising rates, perhaps needlessly, at this point.

How many more banks will fail because of the Fed’s reliance on outmoded and inaccurate data? How many more rate hikes can the banking system even withstand?

According to the Federal Reserve, commercial banks in the United States currently hold about $17.6 trillion in customer deposits - of which about 25% has been invested in inflationary-prone Treasury and agency securities.

Half of that $17.6 trillion is not covered by FDIC insurance. Since Yellin has stated that she is not ready to entertain raising the FDIC insurance caps, over $8 trillion of consumer deposits could be SOL (“Shit Out Of Luck” - sorry, I don’t know where the missing “O” went. Perhaps it knew too much about the Fed’s inflation data).

Banks have less than $3 trillion in cash - hardly enough to handle mass withdrawals.

This begs the question: who will cover the trillions of potential SOL customer deposits?

The Deposit Insurance Fund (DIF), which we were told had reimbursed the non-FDIC covered depositors in both Silicon Valley Bank and Signature Bank, had only $128 billion in its coffers at the end of fourth quarter of 2022.

Whatever is now left in the DIF will certainly not be enough to bailout future bank failures.

Nor could tax revenue cover a mess of this magnitude.

Issuing U.S. debt will be even more problematic now that Treasuries have an inverted risk/reward ratio and banks have run out of OPM. Under these difficult circumstances, the Fed will need to be very, very creative in finding new suckers buyers for their Treasuries.

So, I ask once again, who will pay the tab for this fed-inflicted economic catastrophe?

The great irony is that we-the-people will end up paying for it. And we will pay for it with inflation. So don’t be too surprised if another government money supply metric mysteriously goes missing.

We have reached a critical juncture where inflation has become both the problem and the solution. Because of this conundrum, the Fed’s cycle of doom will continue - endlessly.

That is until decentralized finance saves us.

With paltry CD and Treasuries returns no longer justifying the risk, there has never been a more essential time to diversify with fintech alternatives and to own cryptocurrencies like bitcoin and ethereum.

Unfortunately, the government is going to do anything and everything in its power to stop you from doing so. It is about to go full throttle to try to destroy the cryptocurrency market and force citizens into its tyrannical and destructive digital dollar (CBDC) - because a CBDC is the Fed’s plan to control inflation and ensure buyers for those undesired U.S. Treasuries!

Just you wait. The same people who “silence” inconvenient inflation metrics will soon be shouting that only a CBDC can save the economy. The same people who insisted that there was no inflation in 2021 will swear up and down that the cryptocurrency market is what caused banks to collapse. And, the same people who assured us that Treasuries and FDIC-insured bank accounts were safe, will declare that bitcoin is too risky for retail investors.

Do not be fooled by anymore of their lies.

Look to blockchain-based indices like Truflation for true economic measurements. Protect your wealth with deflationary assets like bitcoin. And most importantly, vote against a digital dollar like your freedom depends on it.

Because it does.