How a Next-Generation Media Company Revived the Small IPO and Galvanized a New Breed of Enthusiastic Investors

One of the many hats that I have worn, during my decades working in finance, was that of a marketer of pre and post small cap IPOs.

It was in donning this particular cap that I first came to not only appreciate the profound impact that IPOs have on shaping the global economy - determining which inventions reach the masses, what jobs are created, and how wealth is ultimately distributed - but also to realize the integral role that marketing plays in this capitalistic process. See: Reg A – It’s More Than Just Tropical Vacation Music – It May Just Be the Catalyst for the Next Small Cap IPO Boom and The Evolution of Securities Marketing and its Impact on Issuers, Intermediaries and Investors.

The fact is that an IPO - or any investment for that matter - does not sell itself. Even Steve Jobs had to hit the pavement, pitching Apple stock to investor after investor, in what is called an IPO roadshow. And the selling doesn’t end simply with a listing and a ticker. Over the next 44 years, even Apple’s CEOs were out peddling Apple stock at investment conferences or in meetings with institutional investors known as non-deal roadshows.

Achieving a successful IPO can be challenging - even for high profile, large cap companies. For lesser known small-cap issuers, especially those using the Regulation A+ exemption, this feat can be next to impossible.

Known as the mini-IPO, Reg A+ was introduced in 2015, as part of the JOBS Act, to offer companies a viable public offering on-ramp so that smaller issuers could raise capital with reduced expenses and a streamlined regulatory process.

Although Reg A+ provides a much more cost-efficient way for smaller companies to go public, because many of these businesses lack sufficient marketing funds or infrastructure, they typically fall short of the financing sought. Furthermore, out of the few Reg A+ issuers fortunate enough to complete their raise and indeed become public, many struggle to survive trading in a marketplace dominated by passive managers, algorithmic traders and abusive short sellers. And when their stock is not getting hammered by apathetic traders, public companies are depleting their capital reserves on costly and overly burdensome regulatory requirements - all at the expense of innovation and sales.

With the exception of the Reg A+ being used, quite successfully, for real estate investing, the Reg-A-mini-IPO has been a real letdown. According to Barron’s, Reg A+ offerings have underperformed by approximately 23 percentage points, compared to small-cap benchmarks like the Russell 2000 Index and the S&P SmallCap 600. Even more disappointing is that a significant number of Reg A+ offerings have been delisted altogether.

These statistics underscore the reality that in order to blossom as a publicly traded company, small businesses need much more than a reconstructed on-ramp. They require a renovated “highway” that is not rife with potholes, antiquated traffic controls and high-speed racecars, constantly trying to run them off the side of the road.

Not many companies can endure these treacherous driving conditions. But Reg A+ issuers are particularly vulnerable. Because these offerings typically have smaller floats, scant marketing budgets and rely on antiquated investor-relations (IR) strategies, they have, unfortunately, become easy targets for market manipulators - particularly abusive shorters.

The fact is that it takes really deep pockets to thrive in today’s public markets. Not only are listed companies continuously spending more and more to meet ever-expanding regulatory burdens, but they also need to allocate more and more capital to investor-relations (IR) just so that they can stay one step ahead of the vultures who are constantly trying to drive their stock price down for no fundamental rhyme or reason.

According to XbInsight, the research arm of IR Magazine, the average annual IR budget in North America is a shocking $799,000. And this doesn’t include the millions more for IR staff expenses as well as the cost of the CEO’s time for reviewing SEC filings, or to be out on the road, marketing the company’s shares.

In 2024, traditional IPOs raised, on average, $170 million per offering - 42 times more than the average mini-Reg-A-IPO of just $4 million. Larger companies can justify allocating millions of dollars, or 1.5% of its IPO proceeds, to the expense of being a publicly traded company. On the other hand, spending 67.5% of a $4 million raise, primarily on IR, is not even remotely plausible - nor would it be ethical. And it would be fiduciarily derelict for an adviser to recommend that a client invest in a company that expends far more money promoting its stock than its actual products.

Without a war chest of IR capital, today’s public company must find other ways to build an impassioned investor-base that can offset the detached traders who seek to exploit them through short sale loopholes.

You may have heard of GameStop Corp (GME), a company that found loyal and enthusiastic investors in its own customers.

Although it is often mocked as a meme stock, the reality is that GameStop possesses something that even most of the deepest-pocketed large caps never will: a vast and fervid “investumer” base. As defined in 2014, investumers are a modern breed of retail investors who invest in the companies that make products that they consume.

With retail investors commanding nearly 70% of its cap table and with over 55 million customers, GameStop maintains one of the most formidable investumer bases on the planet - powerful enough to cause abusive shorters to suffer billions in loses and drive large hedge funds out of business. See: Good Money, Dumb Money, Smart Money, Brilliant Money and Cheese

By comparison, only 10-15% of the typical S&P 500 stock is directly held by retail investors. Because the vast majority of large caps are owned by institutions - many of which are quantitative funds that couldn’t distinguish between a company’s product or dog poop - not even the most well-heeled S&P 500 company, with all of the marketing money in the world, could buy the genuine investumer zealousness retained by GameStop.

This might also help explain why stocks with a smaller concentration of institutional ownership have been outperforming the S&P 500 in recent weeks. Since April 2nd, the institutional-monopolized S&P 500 lost over 5% while investumer stocks, with few institutional holders, like GameStop, saw significant gains.

Case in point: GameStop (GME) is up over 18% since April 2nd. Of course, it doesn’t hurt that GameStop also has a treasury filled with bitcoins, but I’ll save that story for another article.

Trump Media & Technology Group Corp (DJT), another investumer stock, which is only 12% institutionally owned, is up over 15% since April 2nd.

But believe it or not, the best performer of all came from a recent Reg A+ IPO, also with shares primarily concentrated in the hands of retail investors, that had the audacity to go public during recent market turbulence - even as some of the larger and most-highly anticipated issuers delayed their IPO debuts.

On March 28, 2025, OTT (Over-the-Top) media platform, Newsmax announced the successful completion of its initial public offering under Regulation A+, raising the maximum allowed of $75 million through the sale of 7.5 million shares at a public offering price of $10 per share.

Newsmax's stock commenced trading on the New York Stock Exchange under the ticker symbol NMAX on Monday, March 31, 2025 - just days before the markets began to nosedive. The stock opened at $14.65, a respectable 44.6% increase from its offering price, and became the first-ever Reg A+ IPO to result in a direct NYSE listing.

While this alone would be an extraordinary accomplishment for a Reg A+ IPO, more remarkably is that over its first two days of trading, NMAX soared over 2500% to reach $265, accomplishing the largest two-day opening gain for an IPO in U.S. market history.

Although the stock has fallen from its peak, now trading at around $26, NMAX is still up 165% from its offering price - in spite of the recent market tumult.

As someone who has sported the IPO marketing hat, what I find most fascinating about Newmax’s offering is not only how it was able to defy all odds in getting to the public markets, but how it was able to build a solid investor foundation without the marketing muscle from the likes of a J.P Morgan or a Goldman Sachs.

It turns out that Newsmax had something that not even the two largest investment banking firms in the world could provide: a rapidly expanding ardent viewership.

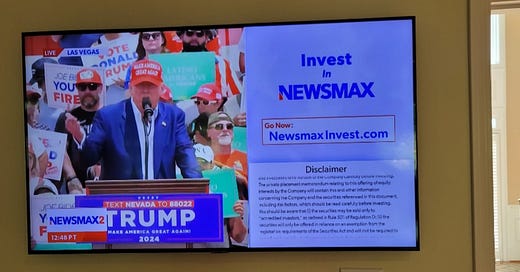

As one of its 40 million viewers, I was intrigued by how Newsmax would use its media platform to publicize its offering directly to its viewers - particularly during programming that would garner a substantial number of eyeballs.

Through its dedicated investment portal, NewsmaxInvest.com, everyday Americans discovered how they could participate in a pre-IPO offering - something typically reserved for venture capitalists, private equity firms or ultra wealthy individuals.

Its minimum pre-IPO investment of just $500 enabled Newsmax to convert many more viewers into shareholders, allowing the company to benefit from a larger and more diversified investor-base. Click here to read how more expansive and diverse investor bases bring greater market stability and help make sure that stocks are valued based on fundamentals as opposed to isolated market events.

Based on the after-market performance, I suspect that Newsmax’s offering was oversubscribed and that the company obtained a very respectable conversation rate.

Even if Newsmax was able to get just 1/2 of 1% of its viewership to purchase the 50-share minimum, its initial public offering would have been oversubscribed by more than 30%.

14 years ago, I suggested that Facebook, with its 800 million users at the time, use a similar playbook for its IPO. See: How Facebook’s IPO Could Transform the Capital Markets

Instead, assuming it would be far more efficacious, Facebook took the conventional IPO path and went public with Morgan Stanley, J.P. Morgan, Goldman Sachs as well as a handful of other prominent underwriters. But not even the big guns could prevent Facebook’s IPO from being a dismal failure, taking over 14 months for Facebook’s IPO investors to finally break even. See: “Coulda, Woulda, Shoulda” – Lessons Learned from Facebook’s IPO

Only time will tell if Newsmax discovered a winning marketing formula for future IPOs and smaller cap stocks in general. In the meantime, I believe that with its historic IPO, Newsmax has demonstrated not only the promise of OTT as the future of media, but also OTT’s ability to galvanize investumers. As a result, maybe, just maybe, Reg A+ could become the great facilitator of small business capital formation after all - instead of prey for market manipulators.