Five Reasons Why All Financial Advisors Will Be Recommending Next-Gen Alternative Assets

And how bolder allocation models will fuel the growth of advisory AUM, retail portfolios and the economy at large

I recently penned an article underscoring why 2025 will inaugurate humanity’s alternative era. In the piece, I discussed how the alternative fraction of every industry known to man – particularly finance, media and health – will rise and reign.

Given the acceleration of innovation in the financial services sector, it should come as no surprise that the investment advisory business is one that will be most impacted by this alternative uprising.

Not only is the alternative asset universe evolving and proliferating, but the vehicles being used to hold and custody these next-generation alternative assets are advancing at unprecedented rates.

These financial product modifications will reimagine retirement planning and transform portfolio construction – particularly for retail clientele - who now, more than ever, require greater portfolio diversification and an even vaster array of alternative assets.

Although the majority of financial advisors have now come to view alternative assets as a core component of wealth management, 2025 will be the year that their allocation models start to become bolder, more creative, and quite frankly, far more effective in generating better risk-adjusted returns.

Below are five key reasons why all financial advisors will be recommending next-generation alternative assets and how these changes in their allocation models will fuel the growth of advisory AUM, retail portfolios and the economy at large.

Alternative Assets are vital to enhancing Sharpe Ratios

The Sharpe Ratio is a commonly used metric that analyzes risk-adjusted returns. Essentially, the higher the Sharpe Ratio, the better the risk-adjusted return. And diversification has long been proven to enhance the Sharpe Ratio of a portfolio.

Unfortunately, portfolios comprised solely of traditional assets like stocks, bonds and mutual funds are rapidly becoming less and less diversified over time. The reason is simple. These traditional assets are all derivatives of the same small diminishing pool of publicly-traded companies.

Not only are there now half as many listed companies in the U.S. than there were in the mid-1990s, today’s stock market indexes are dominated by just a tiny subset of the public companies that remain - making proper diversification even more difficult to achieve with conventional assets alone.

In previous decades, the contribution of the top seven stocks to the market capitalization of the S&P 500 have hovered below 20%. Since 2020 this number has skyrocketed. Today, the Magnificent Seven - Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) - make up a staggering 35% of the market cap of the S&P 500.

And that’s not all. The Magnificent Seven also represent a substantial weighting in other popular indexes such as the Nasdaq 100, Russell 1000 and FTSE All-World. In fact, the Magnificent Seven now make up nearly 23% of the MSCI World index and according to Goldman Sachs’ prime brokerage, they account for approximately 20.7% of hedge funds’ total U.S. single stock net exposure, which is the highest level on record.

With the Magnificent Seven infiltrating our domestic and international mutual funds, ETFs, bonds and even our private hedge funds, it is becoming virtually impossible to diversify away from them without next-generation alternatives such as fintech-centric private credit and equity as well as decentralized cryptocurrencies and RWA tokenization.

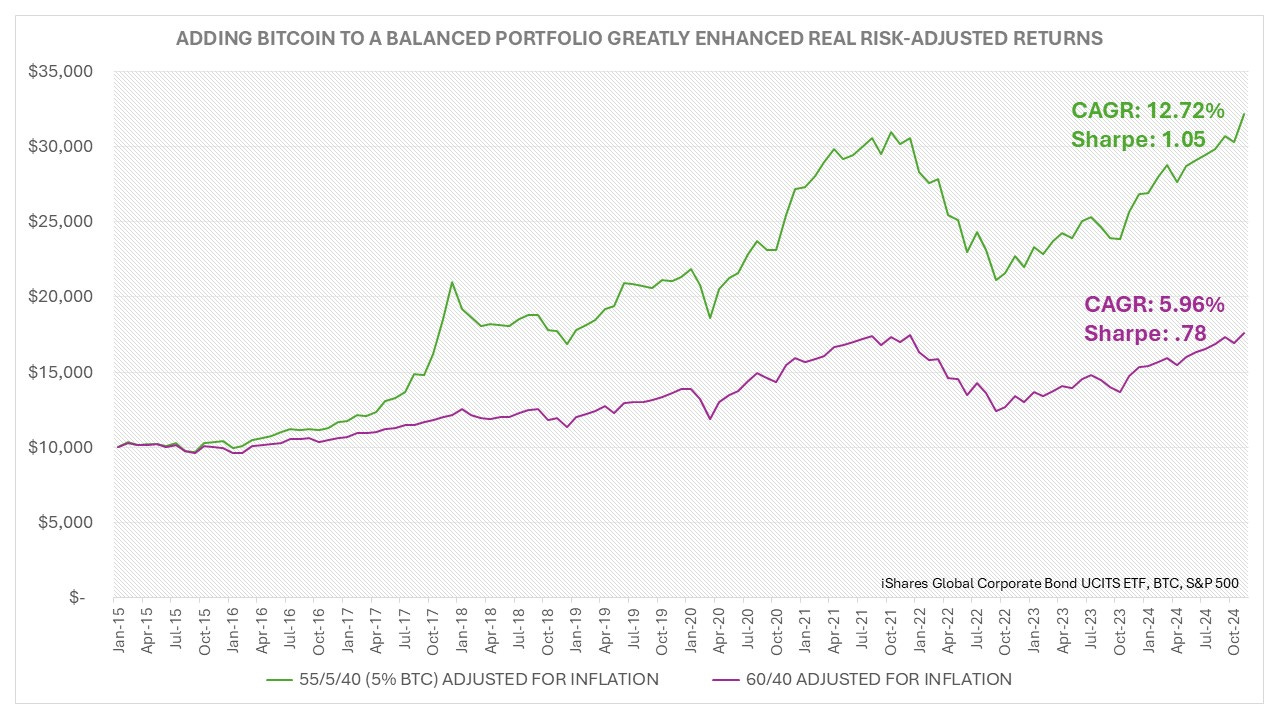

As the chart below illustrates, having added a 5% allocation of bitcoin to a traditional balanced portfolio, in 2015, would have increased its Sharpe ratio by a staggering 35% while more than doubling its compounded annual growth rate.

And this is just the tip of the iceberg, for it is not simply the quantity of assets that is improving, a much better quality of alternative investable products is also emerging. In fact, many of the newer alts coming down the pike will utterly defy conventional risk-reward paradigms, ensuring even more pronounced Sharpe ratio surges in the future.

Next-Gen alternative assets offer greater rewards for lower risk

Thanks to fintech and blockchain innovation, even venture investing is about to become more rewarding and much less risky. Innovations in venture financing are on the cusp of bringing products, like Income Venture Units, to the mass market. These novel venture investments contain the upside potential of a startup along with quarterly dividend payments that are backed by real-world assets (RWAs).

Imagine being able to invest in an early venture, while receiving twice the dividend yield than the average utility stock, secured by a real-world asset such as real estate.

Imagine the magnitude of innovations that would ensue, the sheer number of jobs that could be created, and the economic growth that would follow simply by allowing venture investing to become safer and more prevalent.

Now imagine if you didn’t have to imagine this at all, for the reality of this day is coming.

And it is not just growth investing that is getting a makeover. The fixed income market, too, will soon be unrecognizable with the mainstreaming of products such as bitcoin bonds (bonds issued by entities to purchase bitcoin) as well as crypto mining equipment leasing. Products like these will ensure that the more risk averse investor gains diversification through indirect exposure to cryptocurrencies while also satisfying their income needs.

Next-gen alternatives such as these will become important components of modern portfolios, for they will not only enhance Sharpe ratios, but they will also play an essential role in enabling financial advisors to outperform the market.

AI is making it impossible for financial advisors to compete simply by generating alpha

When it comes to wealth management, every financial advisor aims to generate alpha (outperform the market) while taking the lowest risk possible. This skill is what gives them their edge in an ever-increasing competitive landscape.

In recent years, conventional investment advisors have found themselves having to compete with robo-advisors and fintech platforms. Now advisors must contend with the most formidable opponent of all: the AI Agent.

Artificial Intelligence is transforming how alpha is generated by uncovering hidden patterns in vast datasets, improving prediction accuracy, and automating decision-making. In doing so, AI will enable not only financial advisors, but all investors, to consistently outperform the market.

This will have enormous implications for the financial services industry and for equity markets in general. In one fell swoop, AI will transform traditional stock markets into nothing more than index trading platforms - leaving traditional market investors even more vulnerable to systematic risk and causing advisors to seek new ways to add value.

Financial advisors will be forced to differentiate themselves by offering non-correlated investment products that can only be found in next-generation alternatives as well as by providing emotional-based financial services - something AI is incapable of delivering.

Accordingly, in order to stay competitive, instead of alpha, advisors will need to focus on the behavioral aspects of finance such as retirement and college planning. This is something they will not be able to do effectively without first understanding new web3 earning techniques that redefine how money is acquired and amassed as well as the developing infrastructure used to facilitate the transfer and storage of alternative assets.

Modern Retirement Vehicles will play an integral role in the mainstreaming of alternative assets

Advisors are about to realize that in order to succeed, they will need to familiarize themselves with the emerging bitcoin-based insurance products, innovative custodial solutions and most significantly, the next-generation retirement and savings vehicles.

With all three pillars of America’s existing retirement infrastructure failing to prevent a growing epidemic of senior poverty, it was only inevitable that a superior savings solution would materialize.

Advisors - and the world - will soon be introduced to the REdefined Contribution Retirement Plan, a more sustainable and economically accretive retirement resolution that will not only guarantee a nest egg for each and every American, but it will do so without policymakers having to raise the retirement age, increase payroll taxes, cut promised retirement benefits, or even disrupt existing workplace plans.

Since the REdefined Contribution Retirement Plan will be able to custody alternative assets, in accordance with existing law, in addition to driving immediate economic growth, the REdefined Contribution Retirement Plan will play an integral role in the mainstreaming of alternative assets.

Furthermore, because the REdefined Contribution Retirement Plan can effectively provide a viable savings supplement for the 57 million Americans without access to an existing workplace plan and for the millions more who are financially unprepared for retirement, it creates an extraordinary market opportunity for financial advisors to significantly expand their retail client base as well as their AUM - particularly at a time when the regulatory climate will favor the servicing of retail investors.

There has never been a more favorable regulatory climate for alternative assets

Like magic, with changing of the guard, many of the regulatory bottlenecks that stood in the way of retail investors from accessing alternative assets are rapidly vanishing.

America went from a regime that sought to create a Central Bank Digital Currency (CBDC) and use its securities enforcement arm to prevent retail investors from holding decentralized alternatives to an administration that is prohibiting a despotic CBDC and, instead, exploring the creation of a national cryptocurrency stockpile as well as a regulatory framework to foster a stable digital assets industry. Read: Between the Lines of Biden’s Executive Order on Digital Assets

America also went from having a Department of Labor (DOL) with the expressed desire to “dedicate sufficient investigative resources to [what it deems as] risky investment practices involving illiquid and hard-to-value assets” to an administration whose DOL has a proven track record of strengthening retirement portfolio diversification with private alternatives. Read: Why Americans Should be Cheering the Labor Department’s Recent Move to Open 401(k) Access to Private Equity

With a pro-alternative-asset administration back in the White House, and with some of the most notorious anti-fintech regulators having had exited the SEC, financial fiduciaries will now be able to recommend next-gen non-correlated alternative assets to retail investors without fearing the wrath of overbearing regulators targeting them for doing nothing more than adhering to the diversification mandates as codified in the Uniform Prudent Investor Act (UPIA).

The days of advisors being apprehensive about alternative assets are over, and the time for employing them to fulfil fiduciary responsibility has begun - just as Mark Yusko, chief investment officer of Morgan Creek Capital Management, predicted on my podcast (at the 4:10 mark), nearly four years ago, when he stated that “in less than 5 years, it will be fiduciarily derelict for fiduciaries to have zero exposure to digital assets.”

Next-generation alternative assets are here to stay. And they will not just produce better fiduciaries and generate greater risk-adjusted returns for retail clients. These assets hold the key to ensuring America’s standing as a leading global innovator and economic powerhouse.